2019 was an exciting year for CCA and for our clients. It was a year of growth and another year in which the CCA Model has proven successful. We were able to help companies prepare for liquidity events and help companies execute on liquidity events.

Thank you to our clients who we enjoy working with on a daily basis and make us proud to present the following accomplishments. Also, thank you to our loyal strategic partners with whom we regularly collaborate to meet our clients’ needs. We are proud to share the following highlights from 2019 that represent just a few of our many successes.

In 2019, CCA formally launched its Strategic CFO Services Practice to provide our clients with additional strategic resources and access to experienced corporate operators and executives with a platform to establish and deliver value creation strategy.

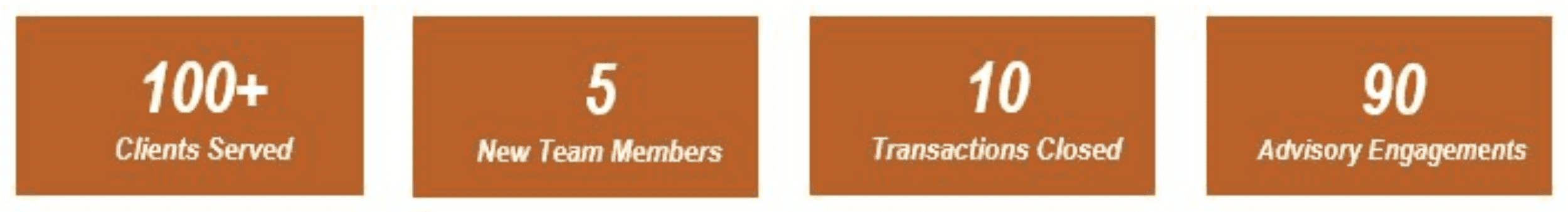

- In 2019, CCA had the opportunity to serve over 100 clients helping them to achieve a variety of different strategic objectives, with the common vision of creating and realizing shareholder value. We are thankful for the deep relationships we have developed over the years and look forward to our continued work together.

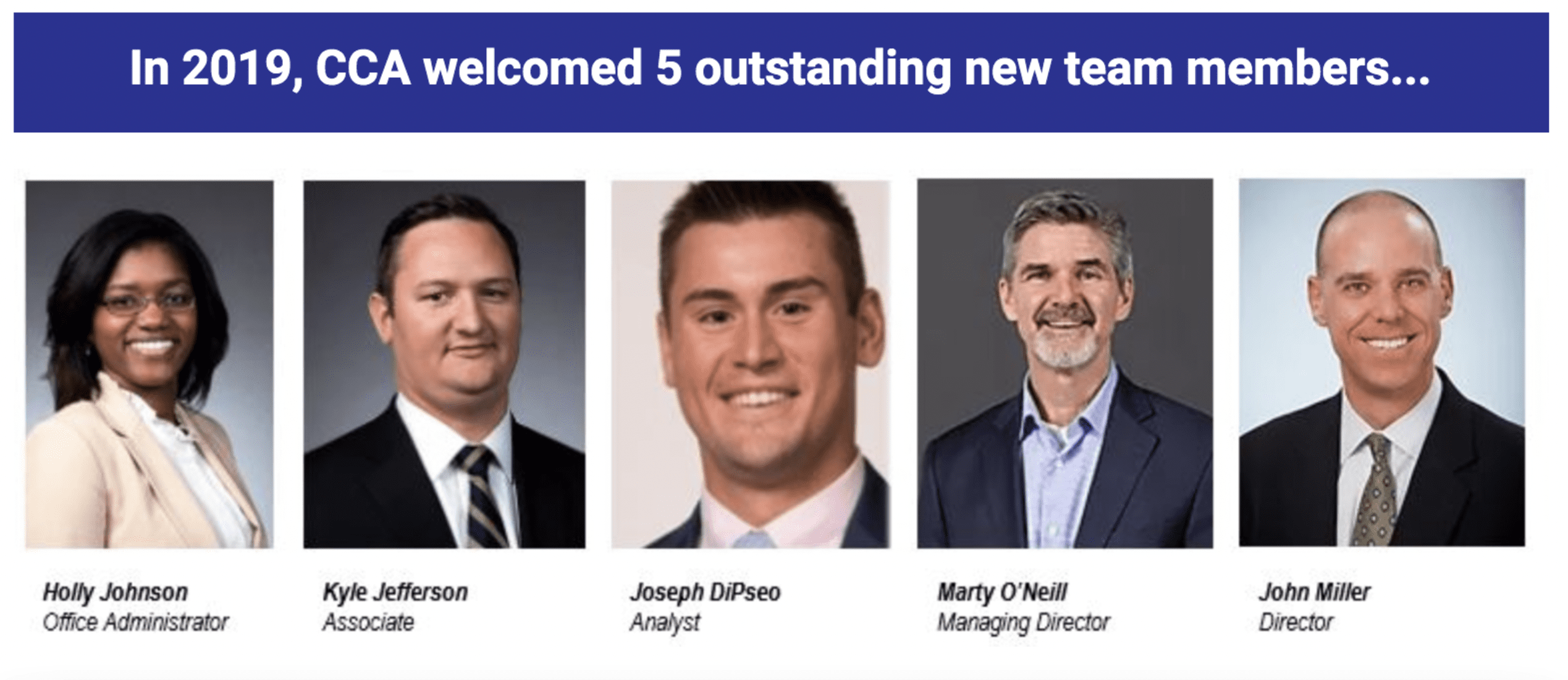

- We added 5 new team members, which allowed CCA to extend our delivery platform to more clients without sacrificing quality or client experience.

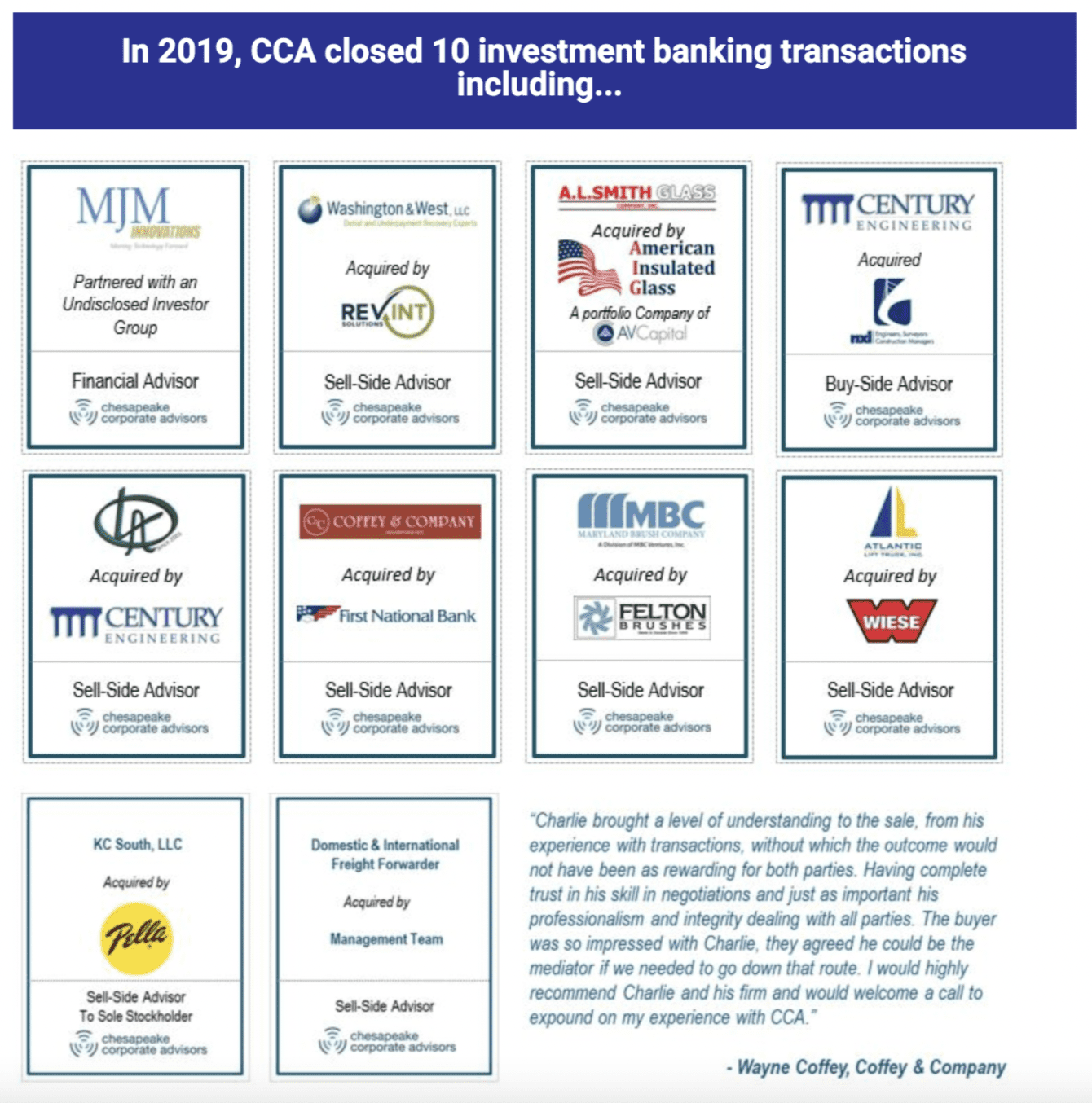

- We closed 10 transactions, which allowed our clients to achieve liquidity and/ or strategic growth through sale, acquisition or a recapitalization.

- We worked with over 90 clients on new engagements, advising clients on valuation, M&A, succession and ownership continuity challenges. We worked with many of our clients to implement value creation strategy, share value with key employees and prepare for an exit or future liquidity event.

- Holly Johnson, Office Administrator, brings an extensive background with her and throughout her career she has worked in office management, human resources and event planning. Holly’s Full Bio

- Kyle Jefferson, Associate, has experience providing clients with sell-side and buy-side M&A advisory services, as well as debt and equity capital raising services, valuation advisory, and restructuring services across a wide range of industries. Kyle’s Full Bio

- Joseph DiPeso, Analyst, will support CCA team members of both the investment banking and corporate strategy practices with financial modeling and analysis, business valuations and industry specific and capital markets research. Joe’s Full Bio

- Marty O’Neill, Managing Director, will be primarily providing advisory services to clients in the government services, technology and business services sectors. O’Neill brings over twenty years of experience in corporate leadership and corporate advisory services to CCA. Marty’s Full Bio

- John Miller, Director, brings over 25 years of experience in commercial banking and corporate leadership to CCA. During his 17-year commercial banking career, he worked with privately held middle market companies across multiple industries. He has spent the last 10 years in executive management roles with various operating companies. John’s Full Bio

- Sell-Side Advisor to MJM Innovations – CCA served as exclusive financial advisor to an innovative technology company which provides fleet and transportation management solutions to an undisclosed financial buyer in the same industry.

- Sell-Side Advisor to Washington & West, LLC – CCA served as exclusive financial advisor to Washington & West, LLC, in its sale to Revint Solutions LLC. Washington & West is recognized as the industry “gold standard” for healthcare-related denials and appeals management. Announcement

- Sell-Side Advisor to A.L. Smith Glass Company – CCA served as exclusive financial advisor to A.L. Smith Glass Company, Inc in its sale to American Insulated Glass, LLC (“AIG”), a portfolio company of Austin, Texas based private equity firm AV Capital. Announcement.

- Buy-Side Advisor to Century Engineering – CCA served as exclusive financial advisor to Century Engineering, Inc. during its acquisition of NXL Construction Services, Inc., a Virginia-based construction management, inspection, and surveying firm. Announcement

- Sell-Side Advisor to Little & Associates – CCA served as exclusive financial advisor to Little & Associates, Inc. in its sale to Century Engineering, Inc. Focused on residential and commercial land development projects, Little & Associates is one of Baltimore’s premier civil engineering & surveying firms, with deep expertise in all phases of the land development process. Announcement

- Sell-Side Advisor to Coffey & Company – CCA served as the exclusive financial advisor to Coffey & Company in the sale to First National Insurance Agency. Focusing on commercial, individual and employee benefit lines, Coffey and Company is one of Maryland’s leading independent insurance brokers. Announcement

- Sell-Side Advisor to Maryland Brush Company – CCA served as exclusive financial advisor to Maryland Brush Company, a division of Maryland Ventures, a specialty brush manufacturer and supplier of stock and custom brushes to industries that include metal work, ferrous and nonferrous mills, tire retread and repair, pipeline and welding fabrication.

- Sell-Side Advisor to Atlantic Lift Truck – CCA served as exclusive financial advisor to Atlantic Lift Truck, a full-service dealership in the Mid-Atlantic, in its sale to Wiese USA.

- Sell-Side Advisor to KC South, LLC – CCA served as exclusive financial advisor to KC South, LLC, a premier distributor of Pella windows and doors in the Southeast, in its sale to Pella. Announcement

- Sell-Side Advisor to a Domestic and International Freight Forwarder – CCA served as exclusive financial advisor in representing the sole shareholder of the Company in an internal sale to the existing management team.

- We performed over 75 business valuations, which allow our clients to have a clear understanding of value and insight into the key factors that drive shareholder value.

- We implemented 8 comprehensive Ownership Continuity Plans to create stable ownership continuity and share value with key employees.

- We worked with 16 companies who are considering a sale to prepare and position their company to achieve maximum value in an upcoming liquidity event.

- We worked with 4 companies to raise new capital or restructure their existing debt in order to provide funding for growth initiatives or fund an internal transaction.