Our Industry Expertise Delivers Better Outcomes

How We Specialize by Sector

CCA has the experience and capabilities to help any middle market company enhance shareholder value and achieve the best price and determines when it’s time to sell or recapitalize the business. While our Corporate Advisory and Investment Banking teams work with clients across a broad range of industries and sectors, the following six industries represent our areas of deepest domain expertise.

But CCA’s expertise isn’t only limited to these areas! If you don’t see your industry listed here, contact us to learn how we’ve helped businesses like yours build, enhance, and realize shareholder value.

Our Industry-Specific Practices

Healthcare

CCA is highly experienced in helping businesses across the healthcare spectrum navigate a complex environment, scale and expand to capitalize on growth opportunities, and position themselves to sell or recapitalize when the time is right.

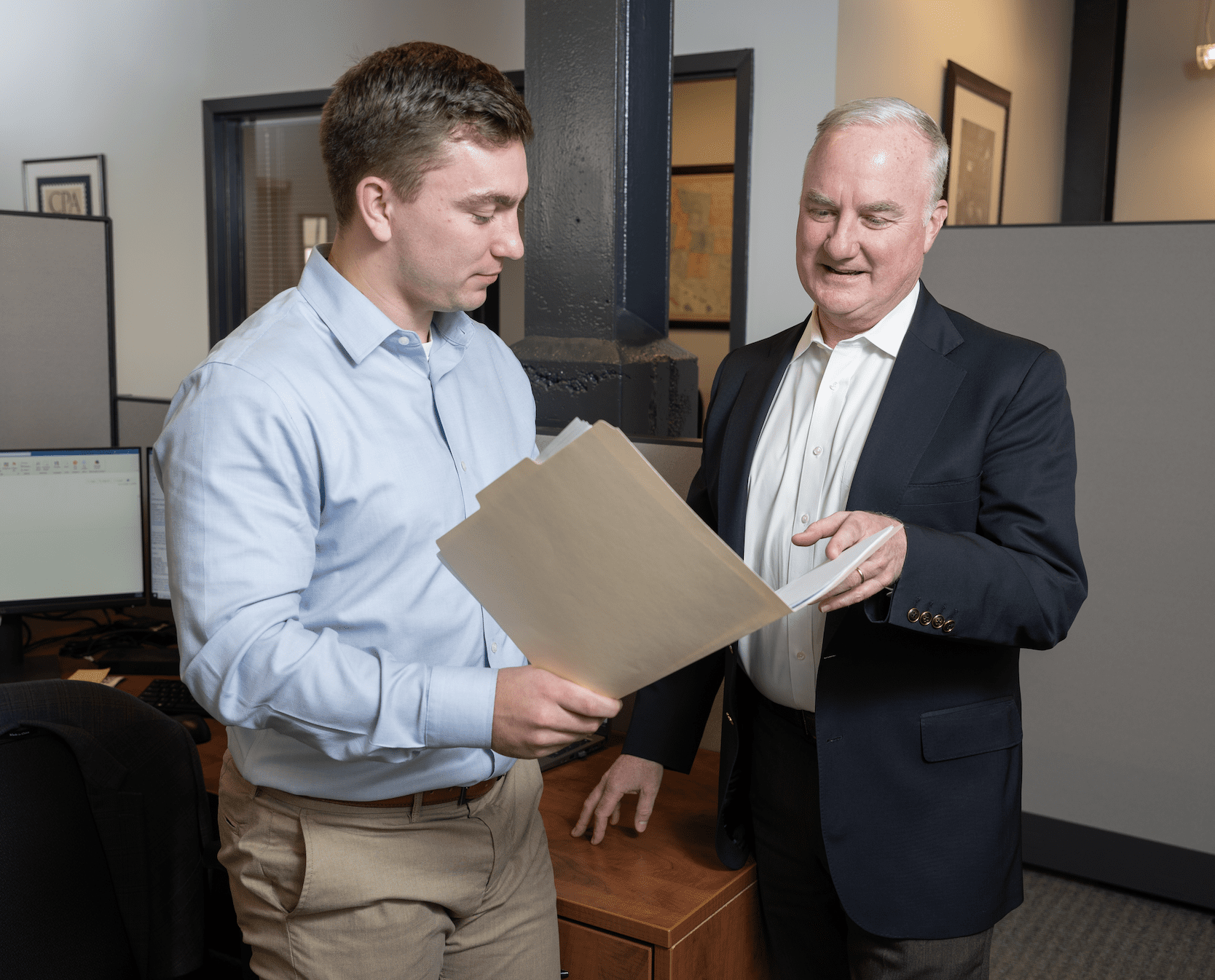

Government Contracting & Information Technology

Government contracting businesses face significant challenges when competing for large, lucrative contracts and the talent to fulfill them. IT businesses that serve public and private sector clients face similar obstacles that can hamper their growth and limits their opportunities.

CCA has extensive experience helping a wide variety of government contractors and IT companies build shareholder value and attract strategic buyers or private equity investment.

Engineering & Construction

CCA has worked with engineering and construction businesses of all types, helping them build value, compete effectively, and achieve the best outcome when it’s time to sell or recapitalize.

Other Industries We Specialize In

Business & Financial Services

Read More

Whatever your goals, CCA’s holistic, collaborative approach and proven process can help your business services or financial services company achieve them. Rooted in a strong understanding your business valuation, we apply rigorous methodologies to help you create and unlock greater shareholder value.

Logistics/ Transportation/ Distribution/ Supply Chain Management

Read More

CCA understands the difficulties of managing costs in an industry impacted by fuel price fluctuations, maintaining the flexibility and elasticity to respond to surges in customer demand, and leveraging technology to improve efficiency throughout the supply chain. Our holistic, collaborative approach, rigorous methodologies, and proven process enables your business to overcome these challenges, build and sustain shareholder value, and achieve a successful sale or recapitalization.

Manufacturing & Distribution

Read More

The CCA corporate advisory and investment banking teams apply a holistic, collaborative approach, rigorous methodologies, and a proven process to determine your business valuation, create greater shareholder value today, and position your manufacturing or distribution company for a successful sale when the time is right.

Don’t See What You’re Looking For?

Contact CCA to learn more about our expertise in your industry.

I am so pleased that the CCA team managed the sale of Radiation Physics, Inc. to PDI Health. Allen Stott was fantastic to work with, a true professional who is totally devoted to helping his clients ease through the sale process with the best possible outcome.

Kenneth L. Miller,

Radiation Physics

The team at CCA was instrumental in completing this transaction successfully. Their expertise and guidance ensured the best possible outcome for all parties involved.

Michael Zumbrum,

AllPure Technologies

CCA has served as an invaluable partner of Kibart and has always delivered exceptional value to our company through its Corporate Advisory services,” said Ed Abbott, president of Kibart. “Thanks to the Investment Banking team’s strong expertise and strategic guidance throughout the process, we have found the right company to join forces with, enabling us to take our firm to the next level.

Ed Abbott,

Kibart, Inc.

We were really happy with the service provided by CCA. They enabled me to stay focused on growing my business while they took care of finding the capital. If there is a next time, we will use them again.

Hugh Sisson,

Heavy Seas Brewing Company

Our Approach

Learn how our proven approach can help you achieve your goals, at every stage in your life cycle.

Related Insights

Confidential Family Office Acquired Peppy’s Car Wash

Chesapeake Corporate Advisors Serves as Exclusive Financial Advisor Baltimore, MD – June 27, 2024 – Chesapeake Corporate Advisors (“CCA”) is pleased to announce it has served as the exclusive financial advisor to a confidential family office in its acquisition of...

Five Factors Are Driving Private Equity Investment in Middle Market Companies

As of May 2024, the influx of over $1.3 trillion in growth and buyout private equity (PE) dry powder has fueled a competitive, but crowded, M&A market for high-quality middle market businesses, even amidst inflationary pressures and elevated interest rates. Large...

Thinking of Selling Your Business? Why You Need a Sell-Side Quality of Earnings Report

This article was originally published on December 1, 2023 on the I-95 Business website. If you are considering selling the business you have worked hard to build, you want a smooth sale process and an optimal outcome. One vital tool that can help you achieve both...

CCA Promotes Frank Ihle and Aidan Olmstead to Senior Analyst

Baltimore, MD – May 14, 2024 –Chesapeake Corporate Advisors (“CCA”), a boutique investment banking and corporate advisory firm based in Baltimore, MD, has promoted Frank Ihle and Aidan Olmstead to the role of Senior Analyst based on their outstanding work in serving...