Overview:

The Federal Reserve continues to monitor the labor market and inflation. Investors are watching closely for signs of a rate cut in June, which will hinge on forthcoming data and will likely be influenced by the Trump Administration’s policies.

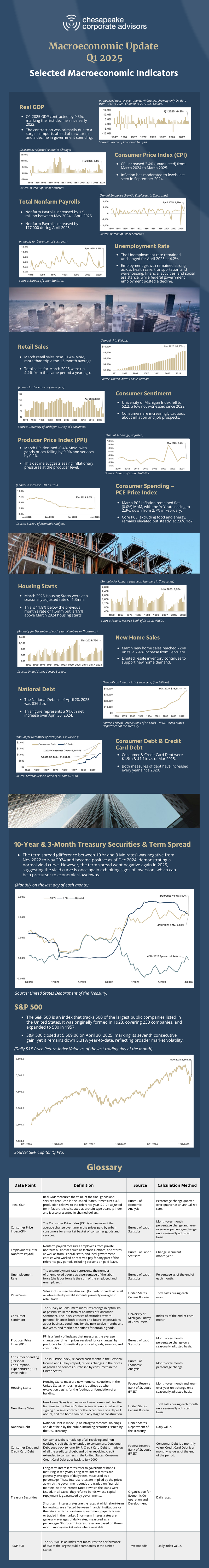

CCA tracks the following 14 economic datapoints, which are some of the common indicators used to monitor the status of the macro economy. A few key takeaways that CCA is monitoring are:

- U.S. GDP declined by 0.3% in the first quarter, marking the first contraction since early 2022. The dip was driven by a spike in imports and reduced government expenditures.

- The labor market added 177,000 jobs in April, indicating continued strength. Additionally, the unemployment rate held steady at 4.2%, pointing to a resilient labor market.

- Inflation, as measured by the PCE Price Index, was unchanged in March on a monthly basis. The year-over-year rate eased to 2.3%, down from 2.7% in February.

- Retail sales increased by 1.4% in March, suggesting that consumer spending increased in advance of tariffs on imports —even as confidence wanes and household debt levels rise.

- Consumer confidence took a hit in April, with sentiment falling to 52.2—the lowest reading since 2022—signaling increased public concern about the economic outlook.

About Chesapeake Corporate Advisors

Chesapeake Corporate Advisors is a boutique investment banking and corporate advisory firm providing strategic advisory services (value creation) and investment banking services (value realization) to companies with revenues between $10 million and $200 million. For more information, visit www.ccabalt.com or call 410.537.5988.