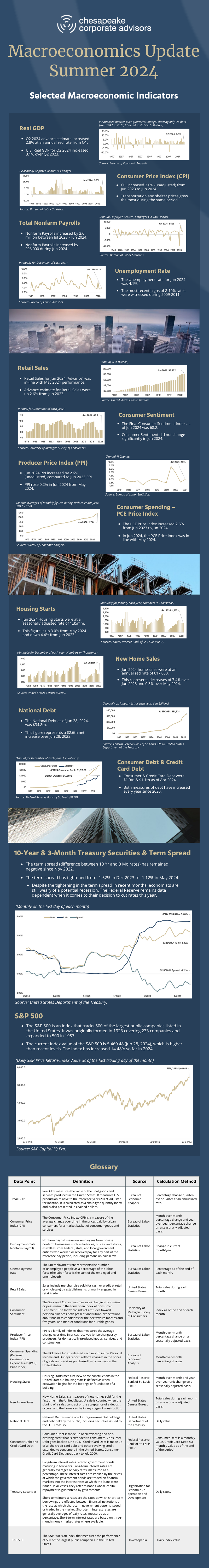

CCA tracks the following 14 economic datapoints, which are some of the common indicators used to monitor the status of the macro economy. A few key takeaways that CCA is monitoring are:

- Fed officials have kept rates steady despite promising data in recent months. The Fed is equally weighting a stable labor market and more data that suggests inflation is trending towards 2% before they cut rates. After its most recent meeting, the Fed has hinted at a potential rate cut in September. Overall, confidence among Fed officials is growing and they believe the economy is normalizing.

- GDP grew at an annualized pace of 2.8% in June 2024, much higher than the 2.1% than economists forecasted.

- The Unemployment rate rose to 4.1% in June 2024, ticking up a bit higher as the labor market started to soften.

- The PCE price index, the Fed’s preferred measure of inflation, increased 2.5% from June 2023 to June 2024, showing a trend closer to the Fed’s target of 2%.

About Chesapeake Corporate Advisors

Chesapeake Corporate Advisors is a boutique investment banking and corporate advisory firm providing strategic advisory services (value creation) and investment banking services (value realization) to companies with revenues between $10 million and $200 million. For more information, visit www.ccabalt.com or call 410.537.5988.