Charlie Maskell founded CCA to provide middle market businesses with the support they need at every stage. “Not every client is ready to sell or in the best position to sell,” he says. “We use a comprehensive process to determine the company’s current value, recommend strategically important ways to increase the value of the company over time, and prepare the business for sale, when the owners are ready, to result in the optimal valuation and terms.”

Charlie leads the CCA teams dedicated to helping businesses enhance shareholder value and position themselves to sell to a strategic buyer, recapitalize with a private equity investor or transition through an internal transaction.

With decades of experience executing countless deals across a range of industries, Charlie achieves exceptional outcomes for his clients by listening and understanding their short-term and long-term objectives… When a client told Charlie that “CCA guided us through the sale of our business with care and skill,” it spoke to the client-centered culture he’s worked to develop and the high-performing team he’s assembled, all singularly focused on client satisfaction.

Valued by clients for his practical approach, Charlie served as the Advisory Practice Leader for the Mid-Atlantic Region of McGladrey and spent many years in partner roles at regional accounting, audit, and consulting firms before founding CCA. He holds a B.A. in Accounting from Loyola University Maryland and a Certificate in Business Strategy from the University of Chicago Graduate School of Business and is a Certified Business Appraiser and Certified Mergers and Acquisitions Advisor.

On the personal side…

When Charlie has some downtime, he enjoys playing golf and spending time with his family. Though he lives in Annapolis, he’s deeply committed to the city of Baltimore—which is evident in the time he devotes to serving on the boards of Mercy Medical Center and Cristo Rey Jesuit High School, as well as his past board positions with Calvert Hall College, Loyola University Sellinger School of Business, and the B&O Museum.

Ready to Talk?

Related Insights

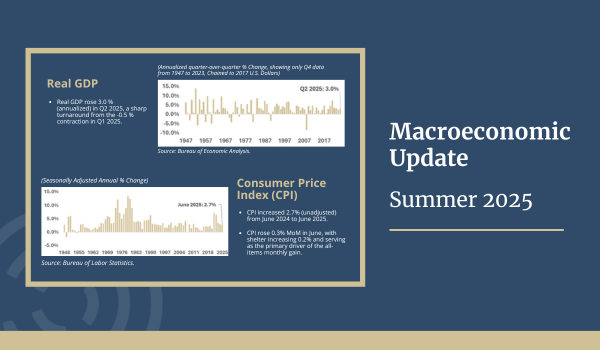

Macroeconomic Quarterly Update (Summer 2025)

Overview: At the July 30th FOMC meeting, the Committee voted 9–2 to keep the federal funds rate at 4.25 %–4.50 %, maintaining a “wait-and-see” stance. CCA tracks the following 14 economic datapoints, which are some of the common indicators used to monitor the status...

Mid-Year Update 2025

At CCA, we are proud to celebrate our 20th anniversary, a milestone that reflects both our history and our ongoing commitment to our clients and community. The first half of this year has been marked by meaningful progress, supporting business owners through complex...

These 5 Components Turn Financial Planning & Analysis (FP&A) into a Growth Driver and Competitive Advantage

To succeed in a competitive market in volatile times, your business needs to make data-driven decisions, optimize performance, and create long-term value. That is precisely what Financial Planning & Analysis (FP&A) enables. A structured FP&A program helps...

From Vision to Value: A Business Sale Story – Part 3

Readiness is the Strategy: What Buyers Look for and How to Prepare... When preparing for a sale, business owners often ask what buyers are looking for. The answer, more often than not, is consistency: growth potential, risk reduction, and operational maturity. In the...