In a fast-evolving landscape, your middle market company might find itself in a precarious position. You are no longer small enough to operate with minimal financial oversight and limited forecasting capabilities, yet you likely lack the resources that large enterprises allocate toward financial planning.

The best way to overcome this challenge is to invest in Financial Planning and Analysis (FP&A). FP&A is much more than a financial function. It’s a strategic function: a structured, holistic approach to obtaining the data-driven insights you need to make informed decisions, optimize performance, and navigate uncertainty.

FP&A is crucial for organizations that seek to drive sustainable growth and maintain a competitive advantage. In a McKinsey survey, more than half of CFOs cited long-term planning and resource allocation as a top finance priority, and 6 in 10 view strategic planning as vital.

If your middle market company is looking to drive profitable growth and thrive even in challenging times, prioritizing and formally committing to FP&A can be a game-changer.

5 Ways FP&A Delivers Value for Middle Market Companies

FP&A encompasses a wide range of finance-related activities, including budgeting, forecasting, financial modeling, and performance analysis, among others. Your business might engage in some, but not all of these finance activities. They might happen ad hoc, rather than in a comprehensive, disciplined manner. Or you might be limiting your focus to historical data (the domain of traditional accounting), as opposed to forward-looking activities that enable you to anticipate opportunities and risks.

A robust FP&A function overcomes these common challenges and helps you use finance as a strategic tool to propel the business forward. FP&A delivers value to middle market businesses in five critical ways.

1. Improved Decision-Making

To make optimal business decisions, you need actionable insights based on accurate financial data. Though every company tracks financial data to some extent, FP&A transforms data into insights that guide informed decisions, zeroing in on the information most relevant to your business. For example, a government contractor needs to diligently track revenue and expenses by contract, the current contract backlog and opportunity pipeline, and the number and status of bids and RFPs. With real-time analysis of the most relevant data, your leadership team can make proactive decisions with confidence—from hiring additional staff to capitalize on new business opportunities, to expanding into new geographic territories or targeting an entirely new customer profile.

P&A also provides the financial forecasts that are crucial to informed decision-making. Many middle market businesses develop a budget, track actual revenue and expense against it, then update the budget on a rolling basis. This approach obscures the picture and fails to provide what leaders truly need to guide decisions: Forecasts that anticipate changing conditions.

2. Better Growth Planning and Scalability Strategies

As your business grows, you need structured financial strategies to support your expansion plans. FP&A helps you identify growth opportunities and determine if it is financially feasible to capitalize on them.

For instance, if you want to pursue new business more aggressively, you need to conduct accurate capacity planning to ensure you can fulfill new orders and contracts. Besides adding staff, you might need to purchase more equipment or even open a new location. FP&A helps you craft effective strategies to support growth, based on sound financial data and forecasts. Importantly, it provides visibility into the capital required to expand the business and informs resource allocation, before you take on the associated expenditures.

3. Improved Cost Control and Efficiency

FP&A can identify operational inefficiencies and opportunities to reduce costs, helping to boost profits. For example, an engineering firm might discover that certain project types have not been profitable historically because the actual labor spent to complete the work exceeded the budgeted hours. Or a service provider might find it is not allocating the right labor to the right jobs, incurring higher costs than necessary.

By strengthening your ability to track the key performance indicators (KPIs) most important to your business, FPA&A allows you to identify problems like these and adjust accordingly. Along with EBIDTA (earnings before interest, depreciation, taxes, and amortization), your company could benefit from better understanding return on assets (ROA), return on capital (ROC), revenue by FTE, lifetime customer value, customer retention rate, or other metrics. Equipped with this data, you can develop and execute strategies that optimize efficiency and ensure your capital is deployed effectively.

4. Greater Investor and Stakeholder Confidence

A well-structured FP&A function builds the financial transparency that investors, lenders, and other stakeholders expect. It further instills stakeholder confidence by demonstrating your business is taking a disciplined approach to financial planning and applying the foresight to anticipate and plan for evolving conditions.

While many middle market businesses have the internal resources to create an accurate profit and loss statement, many overlook the equally vital statement of changes to cash flows. Managing cash is just as critical to your business’s health as managing revenue and expenses. Your stakeholders need to know you have the cash to invest in growth, service debt, and distribute funds to investors on the expected timeline. FP&A activities provide this visibility.

5. Agility in Uncertain Times

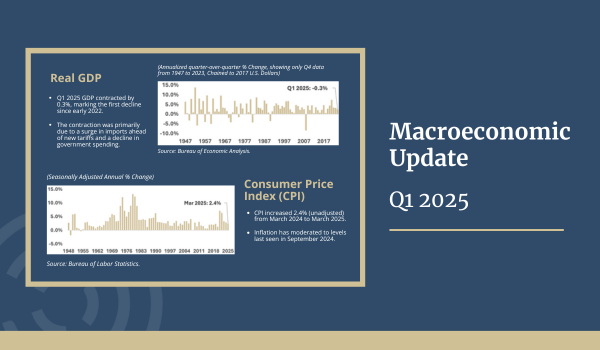

Volatile global trade policies, persistent inflation, and geopolitical tensions are a few of the many uncertainties that can impact your business. You might also face volatility specific to your industry. For example, a pullback in federal spending will impact government contractors, as well as construction and engineering firms that derive a large portion of revenues from federally-funded projects.

FP&A allows you to model different financial scenarios based on various assumptions, then take appropriate measures to improve resilience and reduce risk. Your scenario planning results might indicate you need to strengthen your contingency plans or pivot your strategy to reflect evolving conditions.

FP&A is no longer a luxury for middle market companies. This strategic function is now a must for any middle market company that wants to drive sustainable, profitable growth—especially in competitive markets, amidst unpredictability. Comprehensive FP&A will help the business make informed decisions, improve growth, reduce costs, instill stakeholder confidence, and operate nimbly. In turn, the organization can unlock new growth opportunities and gain a competitive edge.

The Corporate Advisory Team at Chesapeake Corporate Advisors helps middle market companies achieve their goals by providing a broad range of value-add services, including FP&A. We tailor each engagement to your unique needs and lifecycle stage, creating sustainable business value through expert strategy and execution.

Contact us to learn how we can help your business thrive through a disciplined approach to financial planning and analysis.

About Chesapeake Corporate Advisors

Chesapeake Corporate Advisors is a boutique investment banking and corporate advisory firm providing strategic advisory services (value creation) and investment banking services (value realization) to companies with revenues between $10 million and $200 million.