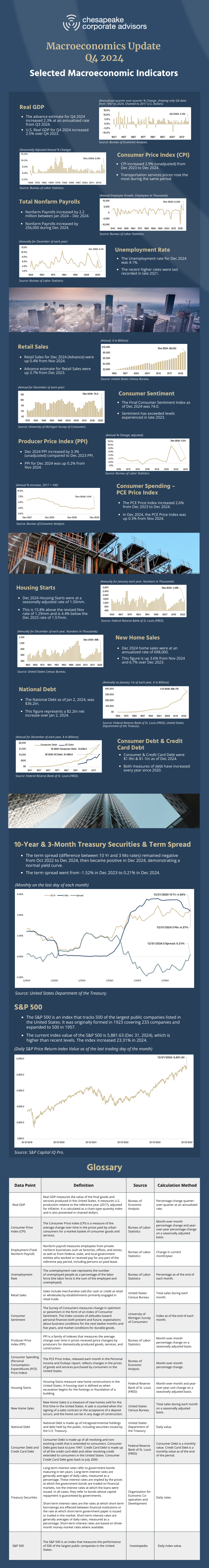

CCA tracks the following 14 economic datapoints, which are some of the common indicators used to monitor the status of the macro economy. A few key takeaways that CCA is monitoring are:

-

- Fed officials cut rates twice in Q4 of 2024, to the effect of 25 basis points both in November and December. The Fed’s target interest rate is currently 4.25 – 4.50%.

- Fed officials chose to leave rates unchanged in January, citing elevated levels of inflation and the strength of the labor market.

-

- Nonfarm Payrolls increased by 256,000 in December, and the unemployment rate decreased slightly to 4.1%.

- The Personal Consumption Expenditures (PCE) Price Index was up 2.6% as of the twelve months trailing December 2024. This is still slightly higher than the consistent 2.0% target that the Fed has their sights on achieving.

-

- The term spread (difference between 10 Yr and 3 Mo rates) remained negative from October 2022 to December 2024, then became positive in December 2024, demonstrating a normal yield curve.

About Chesapeake Corporate Advisors

Chesapeake Corporate Advisors is a boutique investment banking and corporate advisory firm providing strategic advisory services (value creation) and investment banking services (value realization) to companies with revenues between $10 million and $200 million. For more information, visit www.ccabalt.com or call 410.537.5988.