With nearly twenty years of healthcare investment banking expertise, Amanda Verner Thompson leads the healthcare practice at CCA in her role as Managing Director. Throughout her career, she has successfully advised on more than 120 healthcare services transactions, including mergers and acquisitions, strategic advisory, and capital markets advisory, across sectors such as hospitals, behavioral health, managed care, and tech-enabled healthcare.

Amanda brings a unique blend of transactional expertise and emotional intelligence to each engagement, emphasizing that “understanding the client’s goals is paramount to achieving a successful transaction or engagement.” She approaches deals with a clear focus on navigating complex situations and identifying the path to success. “There is always a way to find the finish line, even if the road is winding,” she says. Amanda holds multiple industry licenses and has been recognized as one of ABF’s Top Women in AB Lending and Kayo’s Top 21 in Healthcare.

On the personal side…

Outside of work, Amanda is passionate about tennis and pickleball, with a personal goal of attending all four Grand Slam tournaments—as a French aficionado she thoroughly enjoyed checking off Roland-Garros (the French Open) off her list! She is also actively involved in the healthcare community, serving on the Board of Directors for HealthCare Access Maryland and Roll Out PTSD. She lives in Baltimore with her husband and daughter.

Ready to Talk?

Related Insights

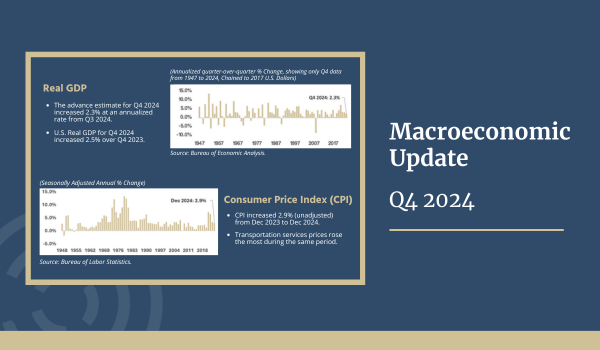

Macroeconomic Quarterly Update (Q4 2024)

CCA tracks the following 14 economic datapoints, which are some of the common indicators used to monitor the status of the macro economy. A few key takeaways that CCA is monitoring are: Fed officials cut rates twice in Q4 of 2024, to the effect of 25 basis points both...

Fireline Corporation Acquired by Encore Fire Protection

Chesapeake Corporate Advisors Serves as Exclusive Financial Advisor Baltimore, MD – January 16, 2025 – Chesapeake Corporate Advisors (“CCA”) is pleased to announce it has served as the exclusive financial advisor to Fireline Corporation (“Fireline”), a top-tier...

End of Year Update 2024

As we close out 2024, we are reflecting on a landmark year for Chesapeake Corporate Advisors. From celebrating our 20th anniversary to navigating a dynamic market, our team has remained steadfast in delivering strong outcomes for our clients and supporting our...

Demystifying the “Second Bite of the Apple” and its Prevalence in Private Equity

Private equity groups (PEGs) are active buyers in M&A transactions, accounting for $1.3 trillion in deals in 2023. US PEGs still have approximately $1.1 trillion in dry powder, which is a massive amount of cash to deploy and invest in businesses. Most PEGs prefer...