When you decide to sell your business, you might have a dollar figure in mind before you even begin the process. Maybe you have heard of other businesses that sold for a certain multiple of revenue and you assume you can do the same. However, revenue is not the only factor in a deal price. Without good cash flow and earnings, you will have a difficult time securing a deal that meets your expectations.

Key Figures That Impact Valuation

A business with growing revenue will surely attract buyers at a good price, right? Not necessarily. Various factors impact your business valuation. Simply growing your top line revenue isn’t enough to ensure a high valuation and a good offer.

Besides revenue, buyers pay attention to two other numbers when evaluating a business and arriving at an offer price:

- Gross profit margin—your total revenue minus your cost of goods sold (COGS)—is one indication of your company’s profitability.

- EBITDA (earnings before interest, taxes, depreciation, and amortization) provides a window into the company’s financial health from an operational perspective, putting aside non-operating factors. As a broad measure of cash flow, it is one of the most critical performance measures for buyers.

Even if your revenue is growing, your gross profit margin and EBITDA figures could be low, stagnant, or declining—all of which are red flags for buyers.

A Tale of Two Companies

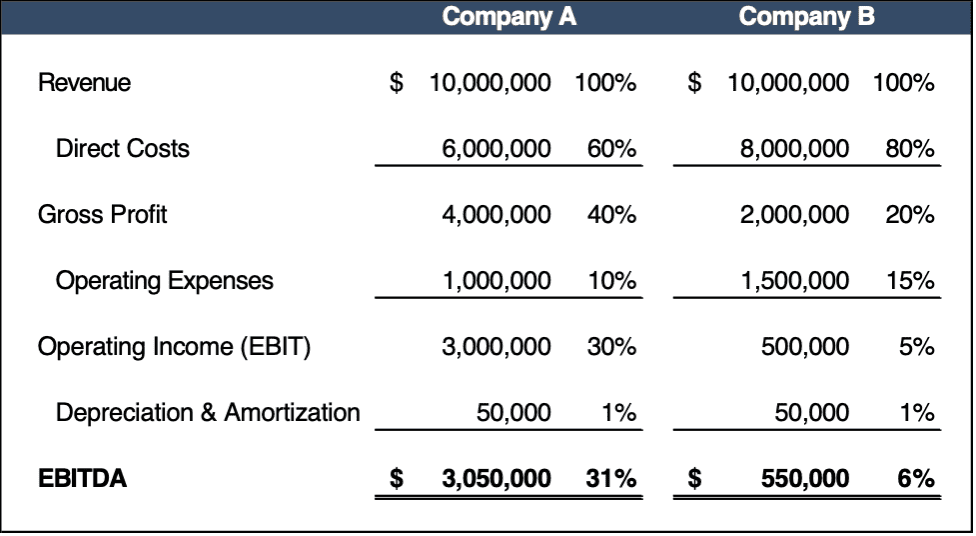

To demonstrate why revenue alone is not a sufficient measure of a business’s value, consider two companies with the same revenue but vastly different earnings.

Company A and Company B both have $10 million in annual revenue. But that is where the similarities end.

- Company A’s gross profit is $2,000,000 higher than Company B’s.

- Company B’s operating expenses are $500,000 higher than Company A’s.

- Company A’s EBITDA is $2,500,000 higher than Company B’s.

The difference in EBITDA is both significant and relevant to a buyer. It means that for every dollar of revenue, Company A sees 31 cents drop to the bottom line while Company B sees only 6 cents reach the bottom line. As a result, a buyer would be willing to pay more for Company A—even though the two businesses have identical revenue—because Company A has much more free cash flow to keep the operation afloat and reinvest in growth.

Why Buyers Pay Attention to Gross Profit

While a buyer evaluates many financial metrics when deciding whether to purchase your company, gross profit margin garners considerable attention. Gross profit margin is an indicator of what your business made after direct costs like labor, materials, and other direct production expenses. It is what you have left to invest in growing the company.

Razor-thin gross margins leave you little room for error, which makes buyers anxious. And those margins are not easy to change, at least not quickly. Many of the steps that can improve margin—such as raising your product pricing or negotiating better deals with suppliers—are not accomplished overnight, especially in some industries. For example, government contractors enter into long-term agreements that set their rates for several years. Buyers know that if they acquire your company, the gross profit margin will likely remain unchanged in the short term. In turn, they look for a strong number right out of the gate.

But while buyers pay close attention to your gross profit margin, it is not the primary driver of the sale price. When deciding what they are willing to pay for the company, buyers are more attuned to EBITDA.

Why You Will Likely Sell for a Multiple of EBITDA

Our example presented two companies with the same revenue but vastly different EBITDA. Company A’s EBITDA reflects that the business is generating sustainable cash flows, which is critical to running a stable operation and investing in growth. All else being equal, the business with the higher EBITDA is worth more to a buyer, resulting in a higher sale price.

So while buyers will consider many factors when evaluating your business, generally speaking the sale price will be based on a multiple of your trailing 12 months of EBITDA. A strong, steady EBITDA over the most recent 12 months is important and, along with a two- or three-year solid track record, gives buyers confidence in the predictability of your future performance, while wild fluctuations or recent dips are cause for concern.

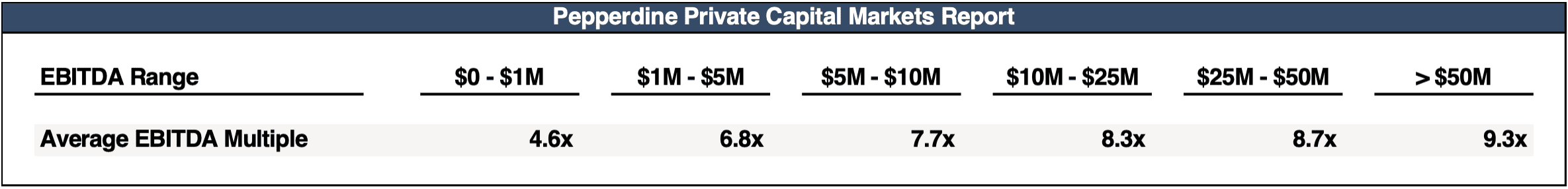

The specific multiple you sell for will be influenced by the quality of your earnings, the diversity of your customer base, and the stability of your customer relationships, all of which reduce earnings risk. Multiples also vary by industry, with sectors like government contracting and technology garnering higher multiples than consumer goods. And across all industries, the multiple rises as EBITDA increases. As shown in the table below, companies with EBITDA of up to $1 million garner lower multiples than companies with $1-5 million in EBITDA.

One caveat to this general rule: In industries where recurring revenue is common, such as SaaS (software-as-a-service) businesses, buyers might value the company based on a multiple of revenue. However, they still expect EBITDA to support the valuation.

There is a common misconception that buyers will factor into the deal price an assumption that they can reduce certain operating expenses post-sale, driving higher profitability. However, even if there are opportunities to trim redundant functions like accounting or HR, a buyer might not pay for those synergies through a higher offer. But they could adjust your historical cash flows for a one-time charge, such as legal fees related to a lawsuit, for a more accurate view of operating cash flow.

Positioning Your Company for a Strong Sale

If you are considering selling your company, it is important to pay attention to your earnings and cash flows, not just revenue. To secure a good offer at a high multiple of EBITDA, you will need to demonstrate a positive 12-month trend in your profit and free cash flow.

The corporate advisory specialists at Chesapeake Corporate Advisors (CCA) partner with owners of privately held businesses to prepare them for the sale process and help them anticipate what a reasonable EBITDA multiple will be for their business, based on their industry, company-specific factors, and the current economic climate. Our experienced team also helps business owners position themselves for the best sale outcome by identifying what drives value in the company and recommending ways to optimize that value before going out to the market.

If you are thinking about selling your business and would like to evaluate how your company stacks up to buyer expectations, contact the experts at CCA.