INDUSTRY UPDATE | Q1 2023

Defense & Government

CCA releases quarterly updates regarding relevant market insights for the Defense and Government Contracting space. Interested in receiving the updates via email? Subscribe here.

Firm Overview

CCA provides customized investment banking and corporate advisory services to middle market companies in the mid-Atlantic region. No matter where you are in your business life cycle, CCA can help you build shareholder value and achieve outcomes that best suit your goals.

$3.0Bn

Aggregate Tx Value

20 years

Average Experience

25

Transactions Closed

Since 2020

84

Valuations and Marketability studies

Corporate Advisory Services

We start by assessing the value and marketability of your business—arriving at an objective business valuation that serves as the essential foundation for determining how to enhance that value through strategic initiatives.

Then we use our proprietary framework to evaluate and arrive at the optimal strategic alternatives to help you achieve your goals. If a business succession or exit is in your plans, our team will help you explore the best options to set you on the right path and ensure a smooth transition—so the business is ready when you are.

Investment Banking Services

Clients have trusted CCA as their investment banking advisor for 30+ years. When you choose CCA as your investment banker, your goals become our goals. We take a comprehensive, holistic approach to achieving the most successful transactions, both domestically and across borders—from preparing you to go to market, through the process of negotiating and closing a deal that produces the optimal results.

Defense & Government Themes and Perspectives

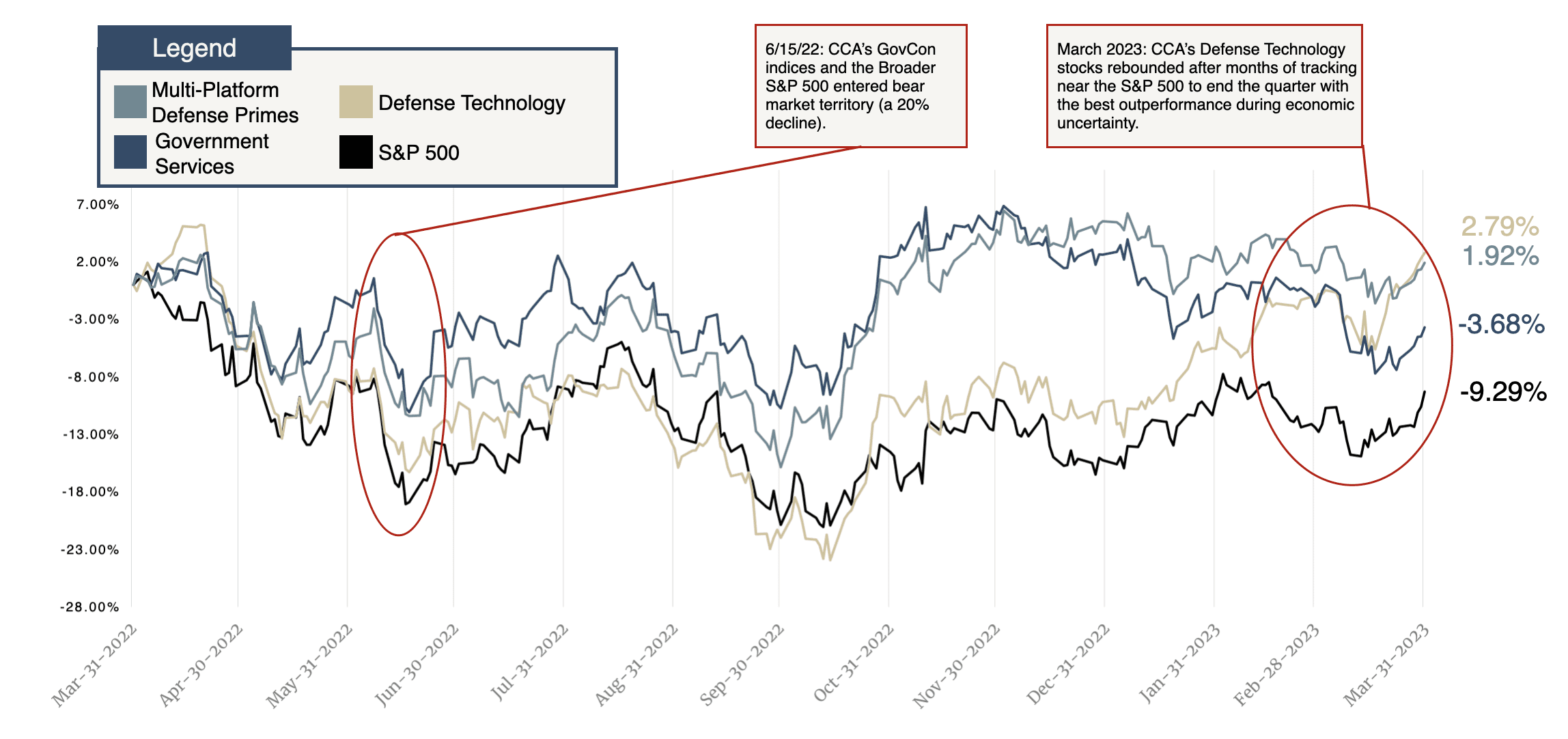

The year was characterized by market headwinds such as inflation, interest rates and tightening credit markets, however Defense Technology, Defense Primes and Government Services companies were resilient and still overperformed the broader market.

Top Growth Markets

According to Bloomberg Government, more than one in four federal procurement dollars is spent in six federal markets. In order of spending, they are Cloud Computing, Artificial Intelligence and Machine Learning, Base Operations and Logistics, Business Management and Financial Services, Facilities Services and Digital Services.

Market Headwinds

Alliant 3 Unrestricted

Market Trends for ADG

Private Equity Remain Active

Private Equity accounts for roughly 50% of current M&A transactions. Private equity dry powder hovers around $1 trillion as of Q4 2022, according to Pitchbook. Its current rate is down slightly from its previous record, $1.8 trillion, at the beginning of 2022. The market expects private equity to be active in 2023 through buy and build strategies.

Defense Technology Perform Well

Market Segment News

Companies serving the Intelligence and Cyber Markets encompass a wide range of offerings with a diverse set of skills and market segments. From Artificial Intelligence and Machine Learning to Cybersecurity and support for the warfighter, the people that make up these technology companies are actively involved in national security. Along with these “pointy edge of the sword companies” are support industries in staffing, construction, finance, and legal which serve to support the infrastructure, financial, and legal needs of this community.

Cyber Command Releases Budget

The DoD’s fiscal 2024 budget includes U.S. Cyber Command’s first every budge as it assumed full budget authorities and resources for the cyber mission forces. According to DefenseScoop, “The FY24 budget is a significant milestone for CYBERCOM since it is the first planned budget submission under EBC authorities.”

National Cybersecurity Strategy

Possible New Cyber Intel Center

U.S. Cyber Command has signaled interest in establishing an independent center focused on collecting and sharing foreign cyber intelligence, according to the Federal News Network. The proposed center would be a joint effort with the NSA and the DIA with a focus on international adversaries’ offensive cyber capabilities.

ODNI Releases Threat Assessment

Cyber Mission Forces Expands

HUBZone Maps Changing

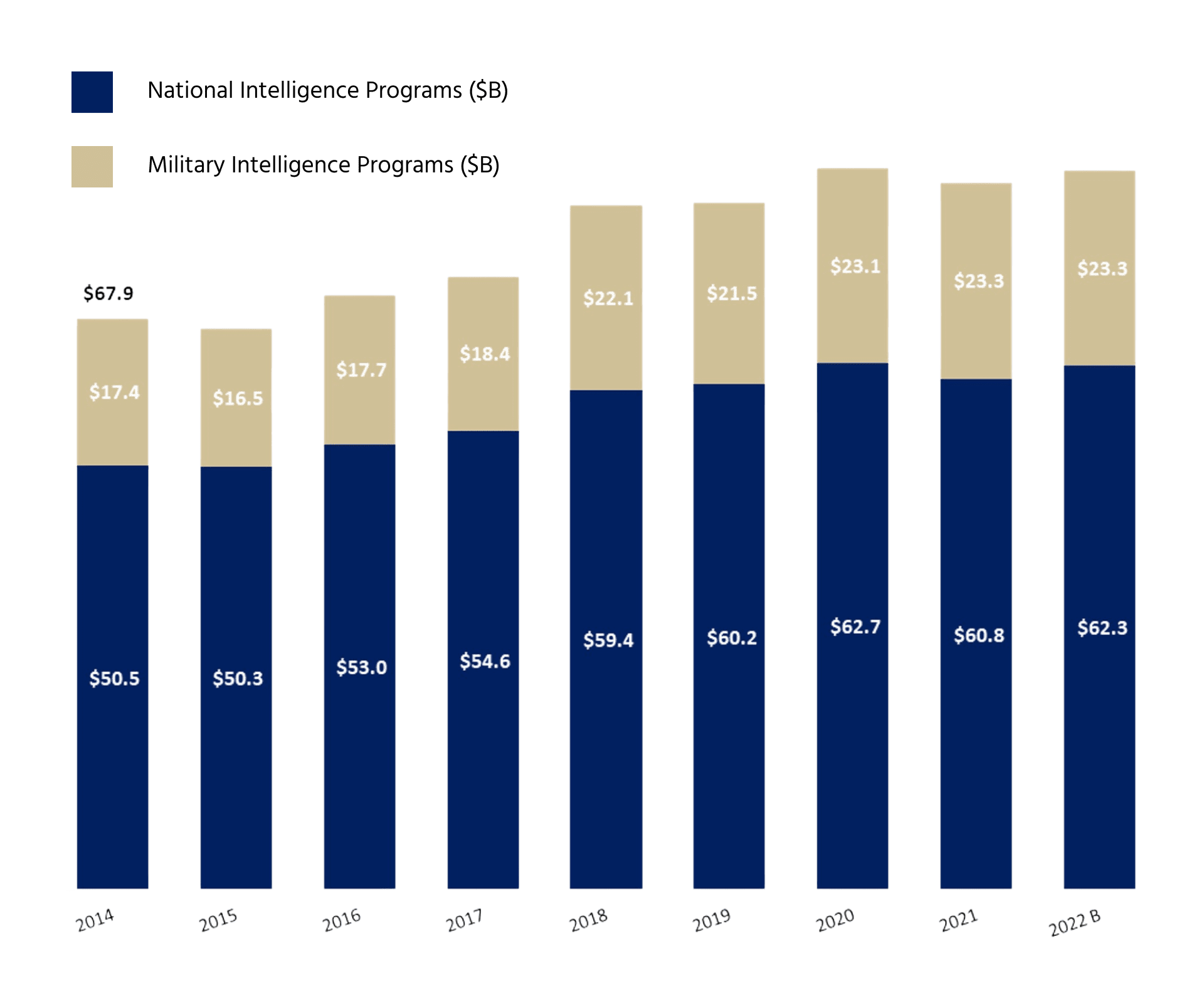

The Intelligence Community Budget

The National Intelligence Program (NIP) includes all programs. IC programs are funded through the: (1) NIP, which covers the programs, projects, and activities of the IC oriented toward the strategic requirements of policymakers, and (2) Military Intelligence Program (MIP), which funds defense intelligence activities intended to support tactical military requirements and operations.

A program is primarily NIP if it funds an activity that supports more than one department or agency (such as satellite imagery), or provides a service of common concern for the IC (such as secure communications). The NIP funds the Central Intelligence Agency (CIA) and the Office of the Director of National Intelligence (ODNI) in their entirety, and the strategic intelligence activities associated with departmental IC elements such DOD’s National Security Agency (NSA).

A program is primarily MIP if it funds an activity that addresses a unique DOD requirement. Additionally, MIP funds may be used to “sustain, enhance, or increase capacity/capability of NIP systems.” The DNI and USD (I&S) work together in a number of ways to facilitate the integration of NIP and MIP intelligence efforts. Mutually beneficial programs may receive both NIP and MIP resources.

Recent Transaction Highlights

- Announced: January 26, 2023

- Sector: Cyber

- Description: Iron Bow Technologies, LLC, a portfolio company of H.I.G. Private Equity, has acquired Guardsight, Inc., a Cedar City, Utah-based provider of cybersecurity operations as a service (SECOPS) and managed detection and response (MDR) solutions for private sector and U.S. federal government markets. Iron Bow stated that its acquisition of Guardsight will enhance “existing cybersecurity solutions portfolio, combining its public-sector cybersecurity engineering capabilities with GuardSight’s private-sector SECOPS and MDR capabilities.”

- Announced: March 31, 2023

- Sector: Cyber

- Description: Optiv Security, Inc., a portfolio company of KKR & Co. L.P., has acquired ClearShark, LLC, a Hanover, Md.-based provider of technical and information technology services to the defense and intelligence sectors. Kevin Lynch, CEO of Optiv, stated that the combined companies are “primed to better help federal agencies and contractors ensure a strong cybersecurity posture and build a lasting legacy in the public sector space.”

- Announced: March 1, 2023

- Sector: Cyber & Intel

- Description: Altamira Technologies Corp., a portfolio company of ClearSky, McNally Capital, LLC, and Razor’s Edge Management, LLC, has acquired (VaST), a Warrenton, Va.-based provider of software development services to private sector and U.S. federal government aerospace and defense markets. Altamira stated that the acquisition of VaST adds “new capabilities in end-to-end SIGINT tasking, collection, processing, exploitation, and dissemination, National/Tactical SIGINT collaborative mission constellation management, and emerging threat identification.”

- Announced: March 21, 2022

- Sector: Cyber & Intel

- Description: In conjunction with its acquisition of Collabraspace, Arlington Capital Partners has formed Eqlipse Technologies, a provider of identity intelligence, advanced research and development, and cyber engineering solutions for private sector and U.S. federal government defense, intelligence, and national security markets. Arlington Capital appoints Dennis Kelly as CEO, Katie Selbe as COO, and Sarah Otchet as CFO. Eqlipse is comprised of Collabraspace, Inc.; Gradient Zero, Inc.; Velocity3 Alliance LLC; Resolute Technologies LLC; and Net Vision Consultants, Inc.

- Announced: March 1, 2023

- Sector: Cyber

- Description: Cherokee Federal, a subsidiary of tribally owned The Cherokee Nation, has acquired Criterion Systems, Inc., a Vienna, Va.-based systems integration and cyber operations solutions firm serving the private sectors and the U.S. federal government. Cherokee Federal stated that the acquisition “expands Cherokee Federal’s offerings and ensures the organization is well-poised to continue meeting evolving customer needs.”

- Announced: January 26, 2023

- Sector: Cyber & Analytics

- Description: AE Industrial Partners, LP (AEI) has acquired REDLattice, Inc., a Chantilly, Va.-based provider of full spectrum cyber capabilities and services for private sector and the U.S. federal government aerospace and defense markets. John Ayers, REDLattice founder and CEO, stated that the company’s partnership with AEI “will bring the resources and expertise to help achieve our goals, dramatically impacting the capabilities we deliver to address our customers’ ever-evolving needs.”

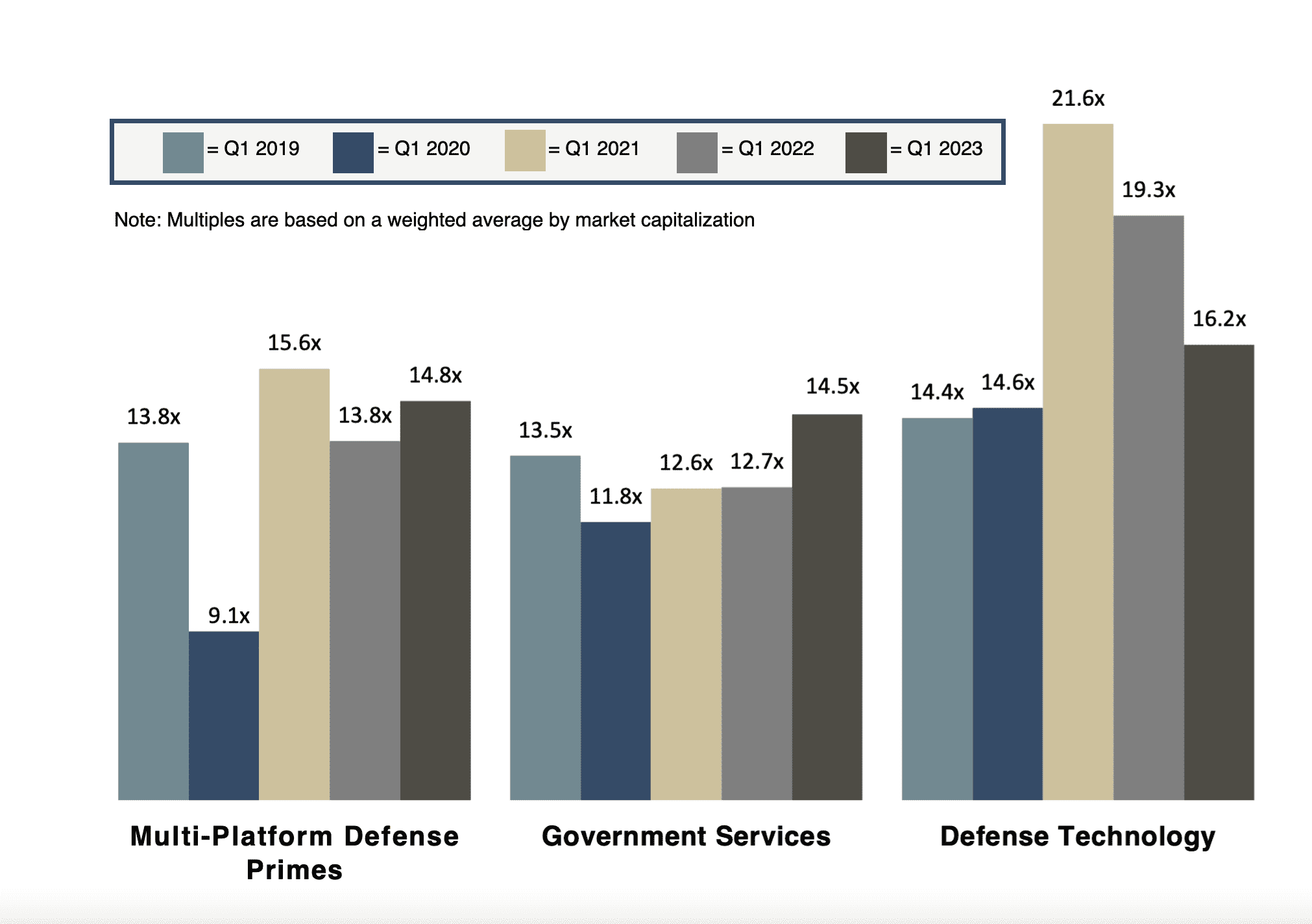

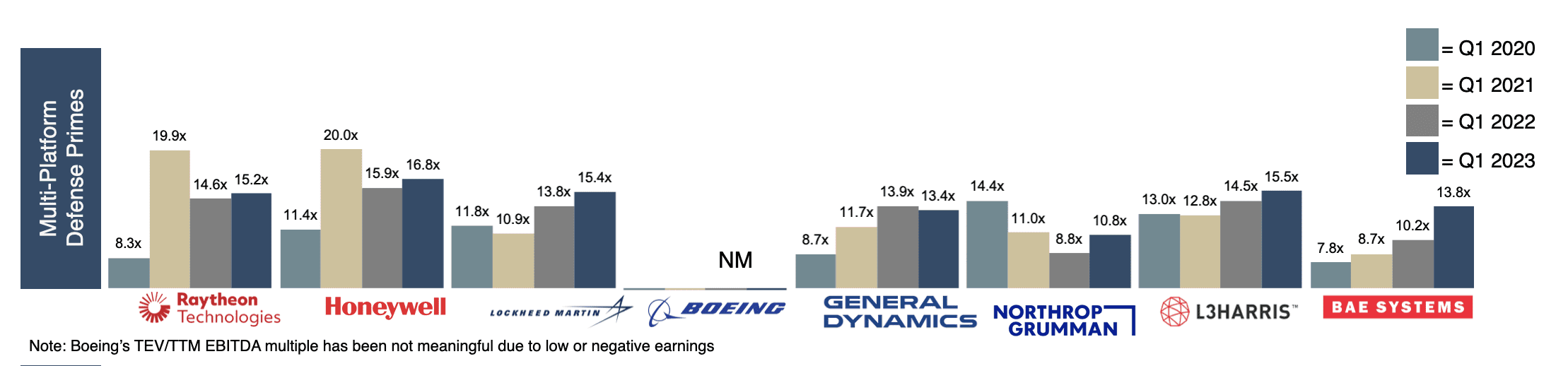

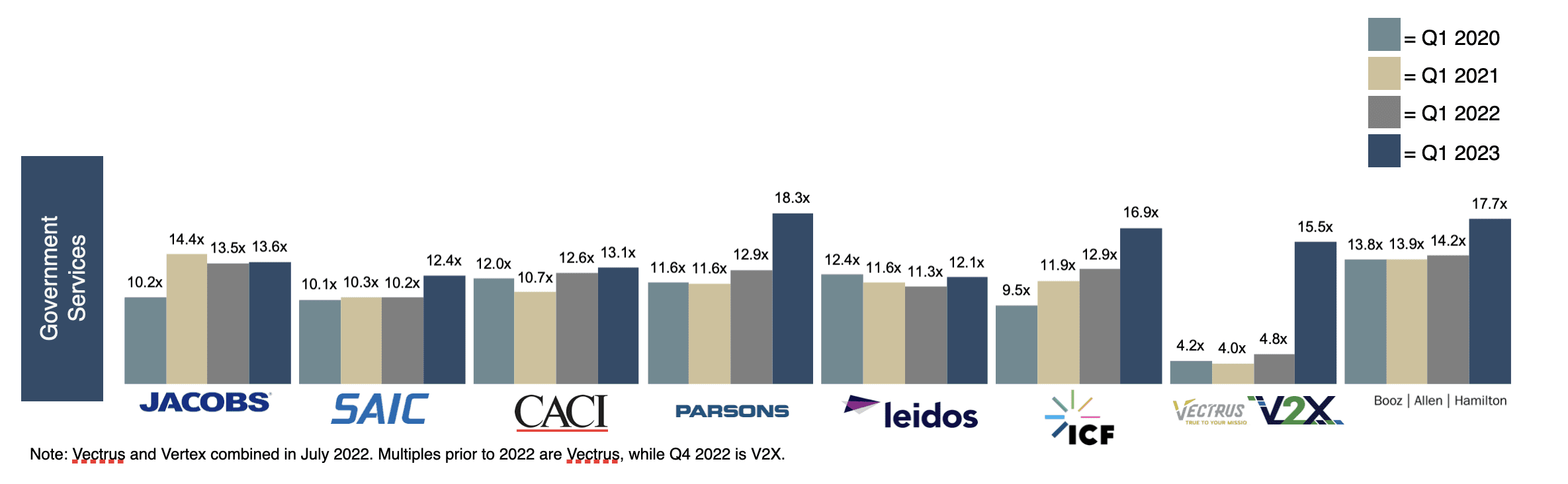

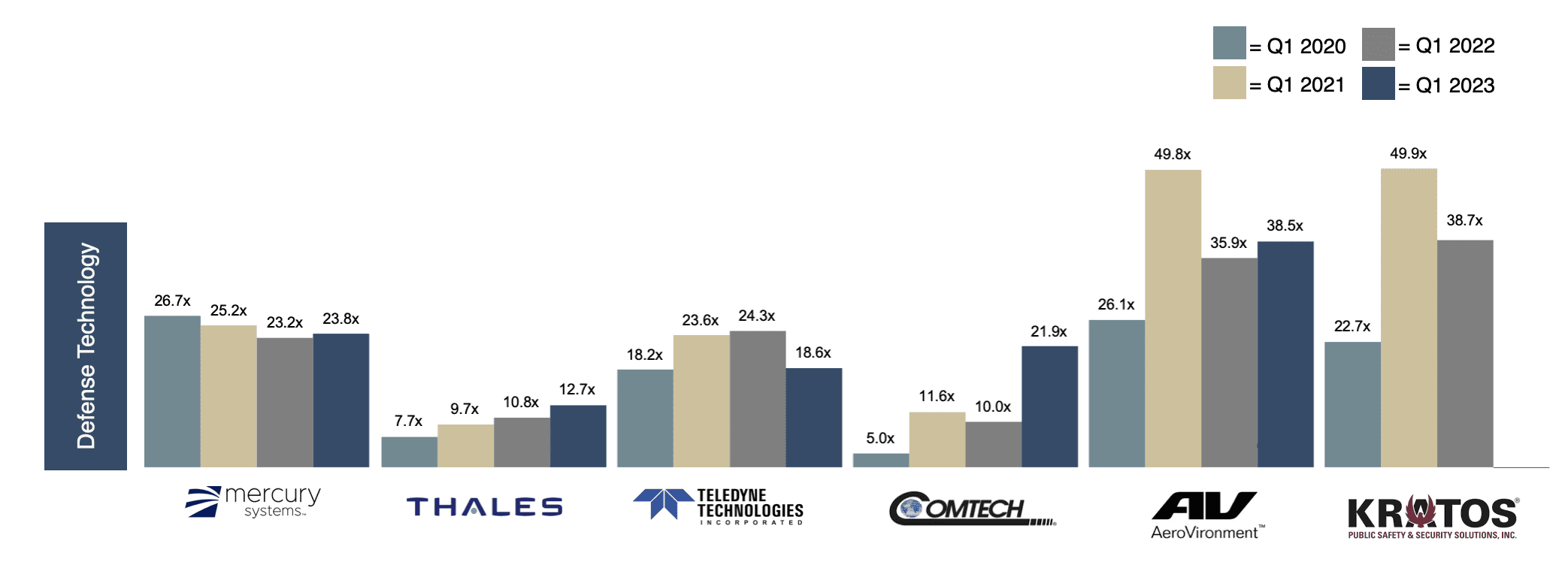

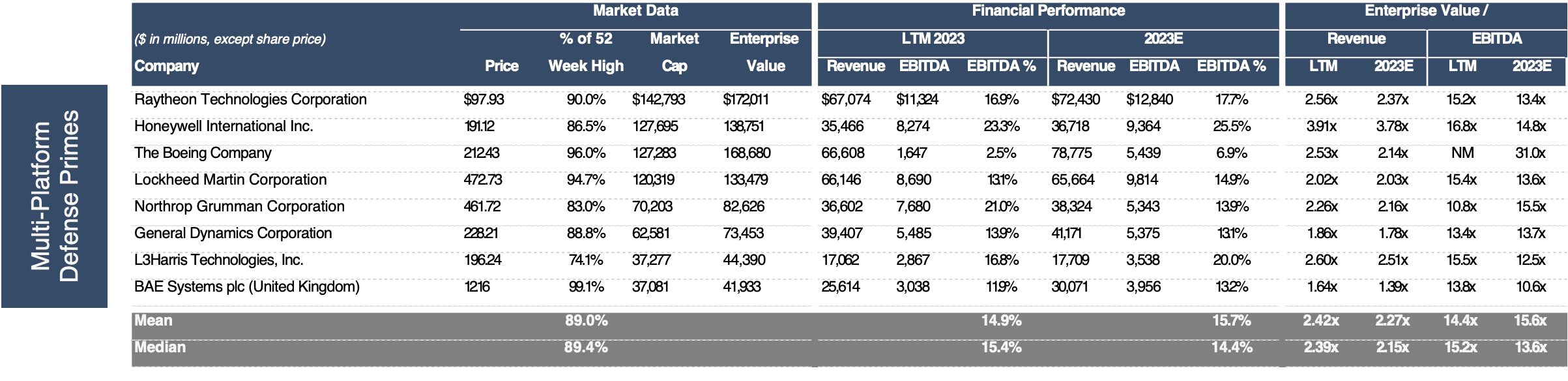

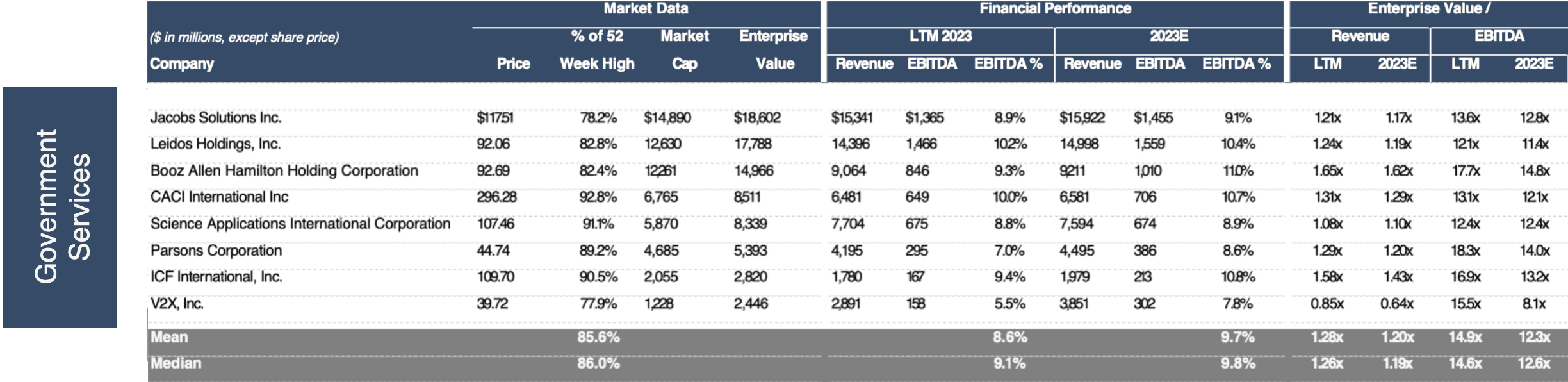

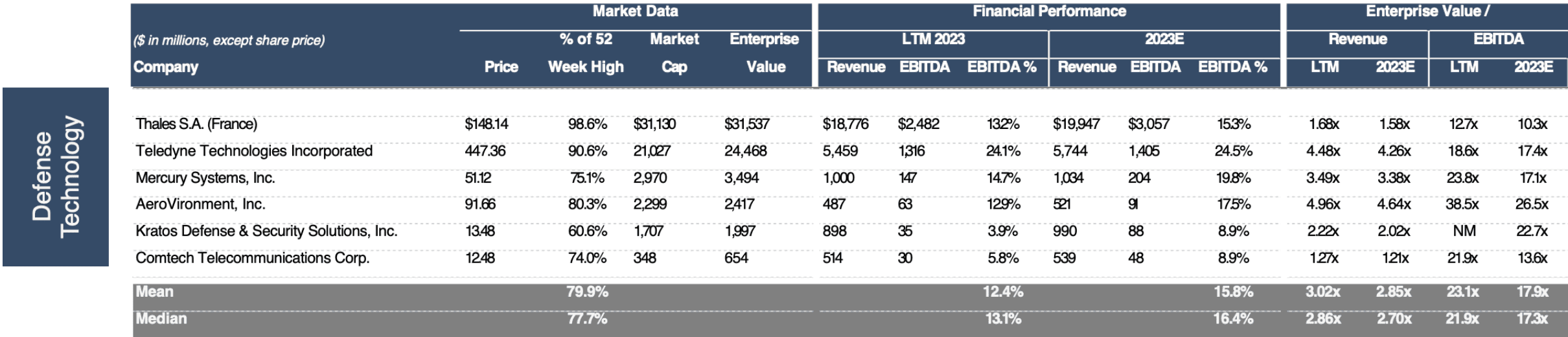

EV/EBITDA Public Valuation Multiples

As we monitor the Government Contracting Industry, we have classified some of the largest government contractors into three main industry sub sectors defined below.

Multi-Platform Defense Primes

Government Services

Defense Technology

Defense prime contractors specialize in the design, construction and support of defense-based products and services. Their work with the Federal Government is typically in a prime contracting relationship as they manage their supply chains and furnish services, supplies or construction to the Government.

Public Market Data

Source: S&P Capital IQ Data as of 03/31/2023

CCA Government Services Indices Stock Performance

- Government Services, Multi-Platform Defense Primes, and Defense Technology indices continue to outperform the S&P 500, with Multi-Platform Defense Primes and Defense Technology stocks in positive territory for the past year.

- Globally, government spending is projected to increase to record levels to satisfy demand and continue to invest in R&D.

How CCA Helps Government Contractors

Strategy &

Corporate Advisory

Chesapeake Corporate Advisors provides a framework for business owners to focus on building sustainable value and to explore their succession and exit alternatives. We use our proprietary tools and methodologies to assess the market and maximize value through strategy.

Investment Banking

Services

CCA is a leading investment bank with extensive expertise in mergers, acquisitions, divestitures, and corporate advisory. We use a comprehensive approach to assist clients develop and execute a buy-side, sell-side or recapitalization strategy domestically and in cross-border transactions.

Business Valuations &

Financial Opinions

At CCA, understanding shareholder value is at the center of everything that we do. Our analysis considers the feasibility of mergers, acquisitions, divestitures, ESOPs, management buy-outs and recapitalizations. We provide an objective, assessment of value that is deeply rooted in qualitative and quantitative analysis using our proprietary methodologies.

CCA’s Government Contracting team is a blend of Corporate Advisory, Investment Banking, and Government Contracting Executives. We have worked with dozens of companies in projects ranging from Sell Side Investment Banking, to Ownership Alternatives, to Valuations to Boards of Directors.

The CCA Government Contracting Team

Charlie Maskell

Managing Partner

Charlie leads the CCA teams dedicated in assisting businesses enhance shareholder value and position themselves to sell to a strategic buyer, recapitalize with a private equity investor transition through an internal transaction.

Martin O'Neill

Managing Director

CCA clients appreciate that Marty has walked a mile in their shoes, having spent 30 years as a business leader in companies of various industries and sizes before joining CCA as an advisor to middle market businesses. Learn more:

Michael Zuidema

Managing Director

In leading corporate advisory engagements for our clients, Mike draws on his track record of serving middle-market and privately-held businesses. Mike Zuidema takes an approach that’s proven to achieve results.

Tim Brasel

Director

Tim leads the day-to-day management and execution of many of the deals CCA transacts for its clients. He’s helped lead and guide the sale and acquisition of numerous middle market companies. Learn more:

Katie Kieran

Vice President

Katie has advised many middle market business owners on how to create value and optimize the outcome when they’re ready to sell, drawing on her strong analytics, strategic, and financial modeling skills. Learn more:

Andy Spears

Vice President

From assisting high-growth market leaders through sale processes to advising companies struggling with cash flow issues, Andy has helped a breadth of companies realize their strategic goals for more than a decade.

Meghan Daley

Vice President

Subscribe to Receive Industry Updates