INDUSTRY UPDATE | Q3 2024

Defense & Government

Firm Overview

CCA provides customized investment banking and corporate advisory services to lower middle market companies in the Mid-Atlantic region. No matter where you are in your business life cycle, CCA can help you build shareholder value and achieve outcomes that best suit your goals.

20 years

30

Transactions Closed Since 2020

84

2023 Valuations and Marketability studies

Corporate Advisory Services

- Value Creation

- Succession and Exit Planning

- Growth Plan Evaluation

- Valuations & Appraisal

- Fairness Opinion

- ESOP Feasibility Study

- Stockholder Agreement

Investment Banking Services

- Sell-Side

- Buy-Side

- Merger

- Recapitalization

- Growth Capital

- Management Buyout

Intel and Cyber News

Companies serving the Intelligence and Cyber Markets encompass a wide range of offerings with a diverse set of skills and market segments. From Artificial Intelligence and Machine Learning to Cybersecurity and support for the war fighter, the people that make up these technology companies are actively involved in national security. Along with these “pointy edge of the sword companies” are support industries in staffing, construction, finance, and legal, which serve the various needs of this community.

Warning of Russian Cyber Threats

Institute of National Security

Pentagon kills Cyber Service Proposal

Continuing Resolution Signed

Total Compensation Plan

No Such Podcast

CCA Serves as the Exclusive Financial Advisor in Q3

SSATI Acquires DATASYNC

VETEGRITY Recapitalized by Private Investor Group

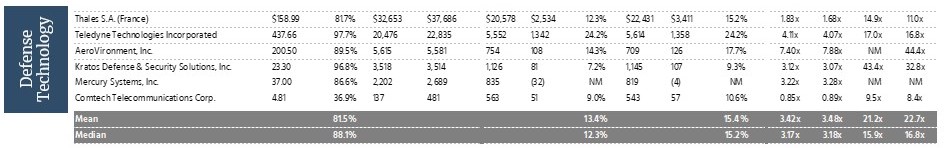

The Intelligence Community Budget

The United States Intelligence Community is a group of separate United States government intelligence agencies and subordinate organizations that work separately yet together to conduct intelligence activities to support the foreign policy and national security of the United States.

Recent Government Technology Services Transaction Highlights

- Announced: October 1, 2024

- Sector: Intel & Cyber

- Description: CACI International Inc (NYSE: CACI) announced that it has acquired Applied Insight, a Northern Virginia-based portfolio company of Acacia Group, in an all-cash transaction. In alignment with CACI’s mission to deliver distinctive expertise and differentiated technology to meet its customers’ greatest national security challenges, Applied Insight delivers proven cloud migration, adoption, and transformation capabilities, coupled with intimate customer relationships across the Department of Defense (DoD) and Intelligence Communities (IC).

- Announced: September 27, 2024

- Sector: Intel & Cyber

- Description: Amentum (the “Company”), announced the completion of its merger with Jacobs Solutions Inc.’s (“Jacobs”) Critical Mission Solutions and Cyber and Intelligence businesses. The combination creates a global leader in advanced engineering and innovative technology solutions, well positioned to address its customers’ most significant and complex challenges. Amentum began regular-way trading on the New York Stock Exchange (“NYSE”) on Monday, September 30, under the ticker symbol “AMTM.” The executive team of the Company also rang the Opening Bell at NYSE the following day, Tuesday, October 1.

- Announced: September 27, 2024

- Sector: Intel & Cyber

- Description: Private investment firm CM Equity Partners has completed its acquisition of Sabre Systems from its majority owner and founder for an undisclosed sum. Established in 1989, Sabre provides technology platforms in software and systems engineering, digital transformation, cybersecurity, enterprise data management and advanced communications systems to support the national security missions of the Department of Defense, military services and federal civilian agencies. James Norris, the newly appointed president of Sabre Systems, will continue to oversee the technology company, while Bill Vantine, a veteran government executive, will serve as chair of Sabre’s new board of directors.

- Announced: September 9, 2024

- Sector: Intel & Cyber

- Description: GDIT, announced that it has acquired Iron EagleX, Inc. (IEX), a leading provider of artificial intelligence/machine learning, cyber, software development and cloud services for the Special Operations Forces and the intelligence community. The acquisition expands GDIT’s portfolio of differentiated technology capabilities and further strengthens its ability to support defense and intelligence missions across all warfighting domains. As part of this acquisition, hundreds of highly technical and cleared employees from 18 locations will join GDIT’s workforce of 28,000.

- Announced: August 8, 2024

- Sector: Intel & Cyber

- Description: Enlightenment Capital, an Aerospace, Defense, Government & Technology (ADG&T) investment firm based in the Washington, DC area, announced it has made a strategic investment in Cryptic Vector, a provider of full spectrum offensive cyber, electronic warfare, and secure radio frequency communications solutions for the IC and DoD. “Cryptic Vector’s technology is shaping the future of information dominance and converged military operations by unifying cyber and electronic warfare operations,” said Devin Talbott, Founder and Managing Partner of Enlightenment Capital.

- Announced: August 6, 2024

- Sector: Intel & Cyber

- Description: SIXGEN, a full-spectrum provider of cyber products, operations, and solutions to the U.S. national security and critical infrastructure sectors, announced its acquisition of Boldend, Inc. (“Boldend”). Boldend develops leading-edge cyber and electronic warfare solutions, empowering the U.S. Government’s operations in an evolving threat landscape. Boldend marks SIXGEN’s second acquisition since Washington Harbour Partners’ (“WHP”) investment in the company in November 2023. Boldend’s suite of software and cyber automation tools will further accelerate SIXGEN’s achievement of its strategic vision to empower the digital warfighter.

- Announced: July 30, 2024

- Sector: Intel & Cyber

- Description: Parsons Corporation (NYSE:PSN) announced that it has entered into a definitive agreement to acquire BlackSignal Technologies, LLC, a Razor’s Edge portfolio company, in an accretive deal valued at $200 million. BlackSignal is a next-generation digital signal processing, electronic warfare, and cybersecurity provider built to counter near-peer threats. This acquisition will expand Parsons’ customer base across the DoD and IC and significantly strengthen Parsons’ positioning with full-spectrum cyber and electronic warfare. The transaction is consistent with Parsons’ strategy of acquiring high-growth companies with greater than 10% revenue growth and adjusted EBITDA margins.

- Announced: July 2, 2024

- Sector: Intel & Cyber

- Description: SIXGEN, a full-spectrum solutions provider of cybersecurity products, announced its acquisition of Secure Enterprise Engineering, Inc. (“Secure-EE”). Secure-EE is a leading provider of bespoke cybersecurity products and services across various domains, and marks SIXGEN’s first acquisition following Washington Harbour Partners’ (“WHP”) investment in the company in November 2023. This acquisition brings unique capabilities, software products, tier I engineers and longstanding customer relationships, accelerating SIXGEN’s strategic vision to empower the digital warfighter.

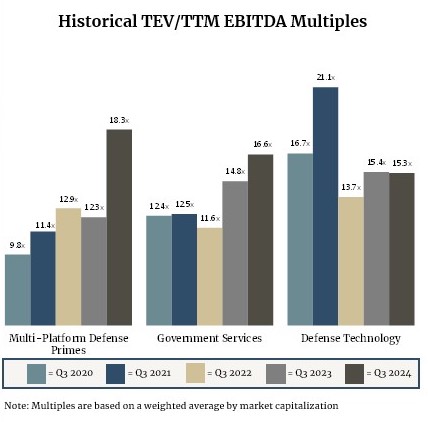

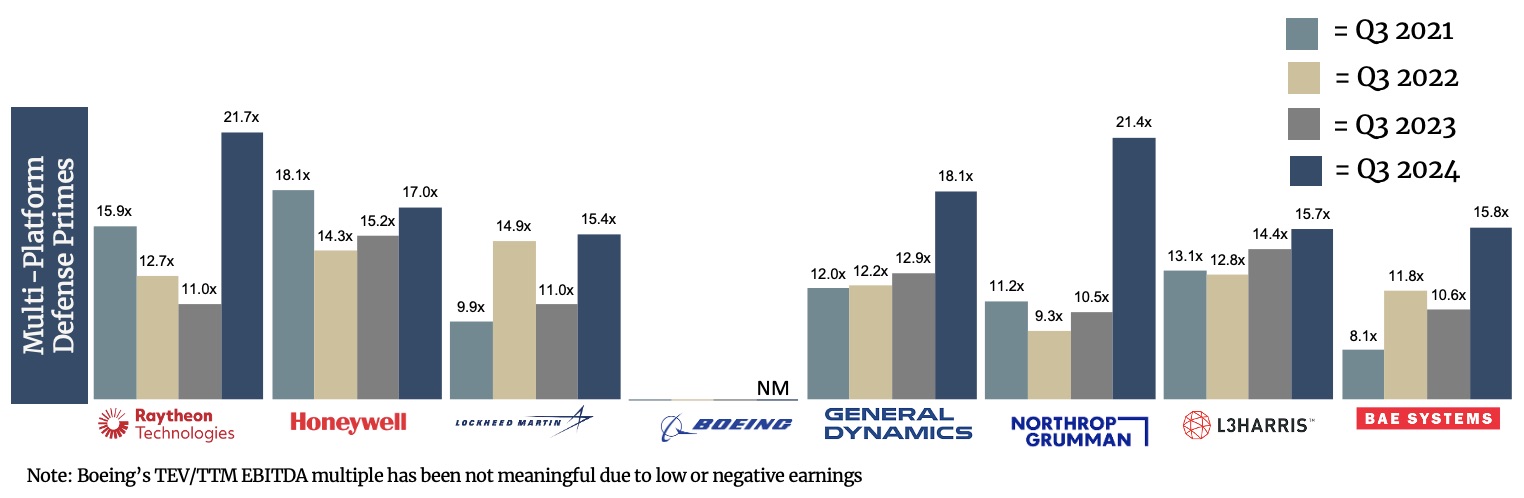

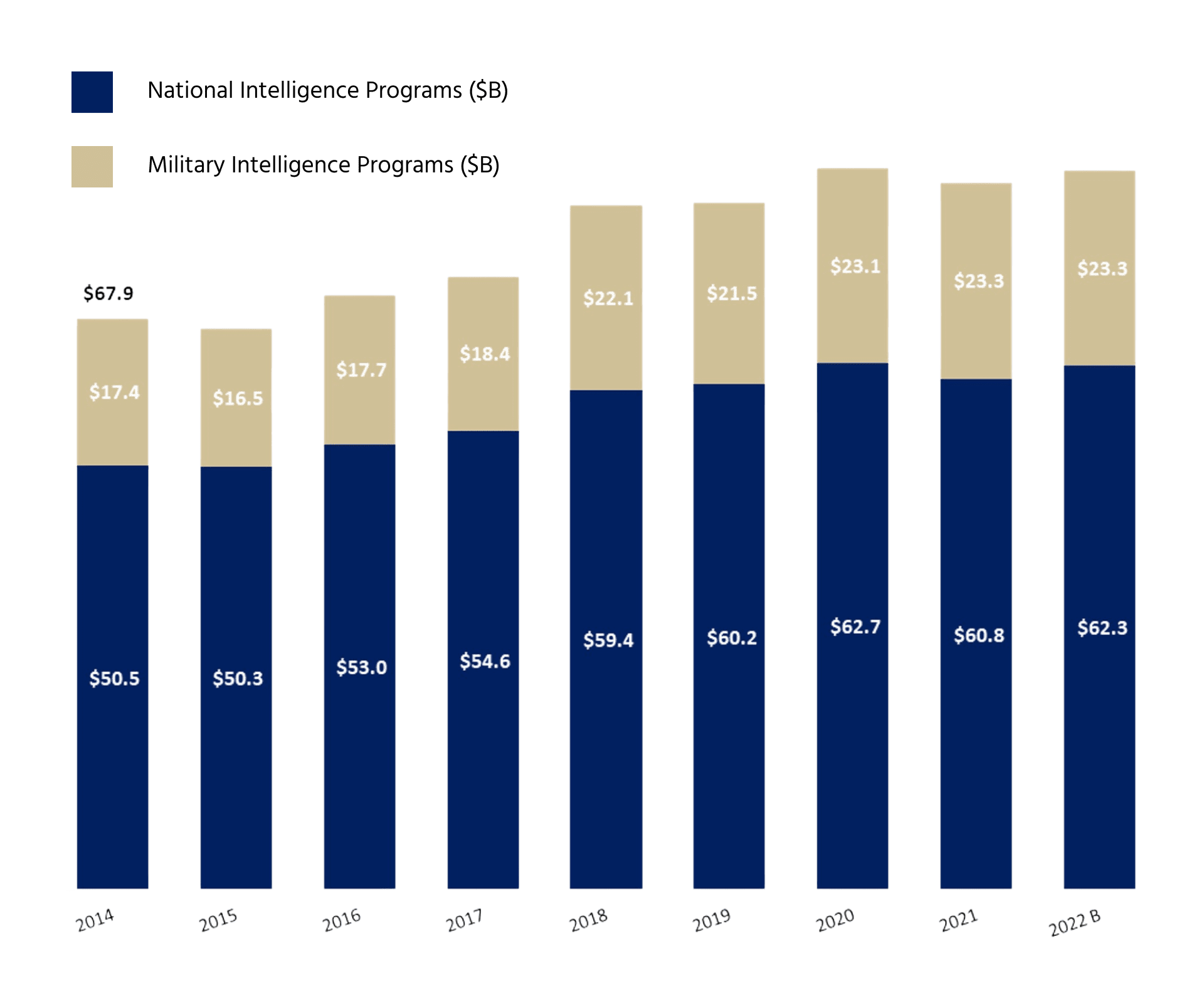

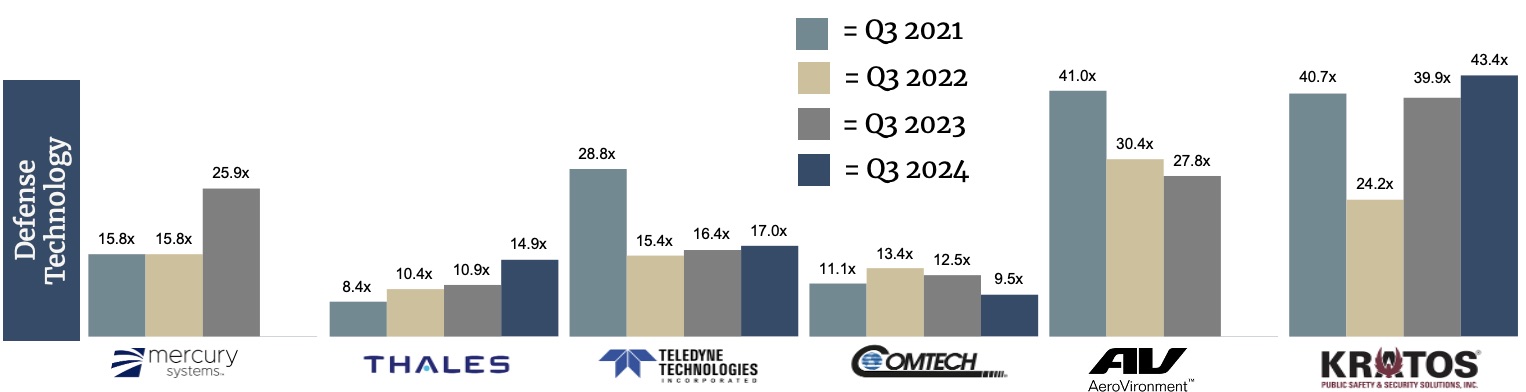

EV/EBITDA Public Valuation Multiples

As we monitor the Government Contracting Industry, we have classified some of the largest government contractors into three main industry sub sectors defined below.

Multi-Platform Defense Primes

Companies typically involved in the interdisciplinary fields of engineering and engineering management in the delivery of defense related products and services. This includes, but is not limited to weaponry, munitions, electronics and cyber related products and services.

Government Services

Defense Technology

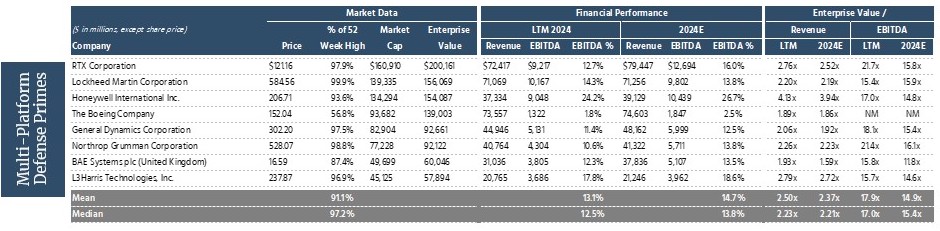

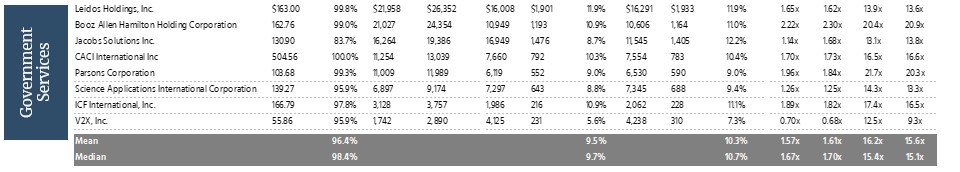

Public Market Data

Multi-Platform Defense Primes

Government Services

Defense Technology

Source: S&P Capital IQ Data as of 06/28/2024

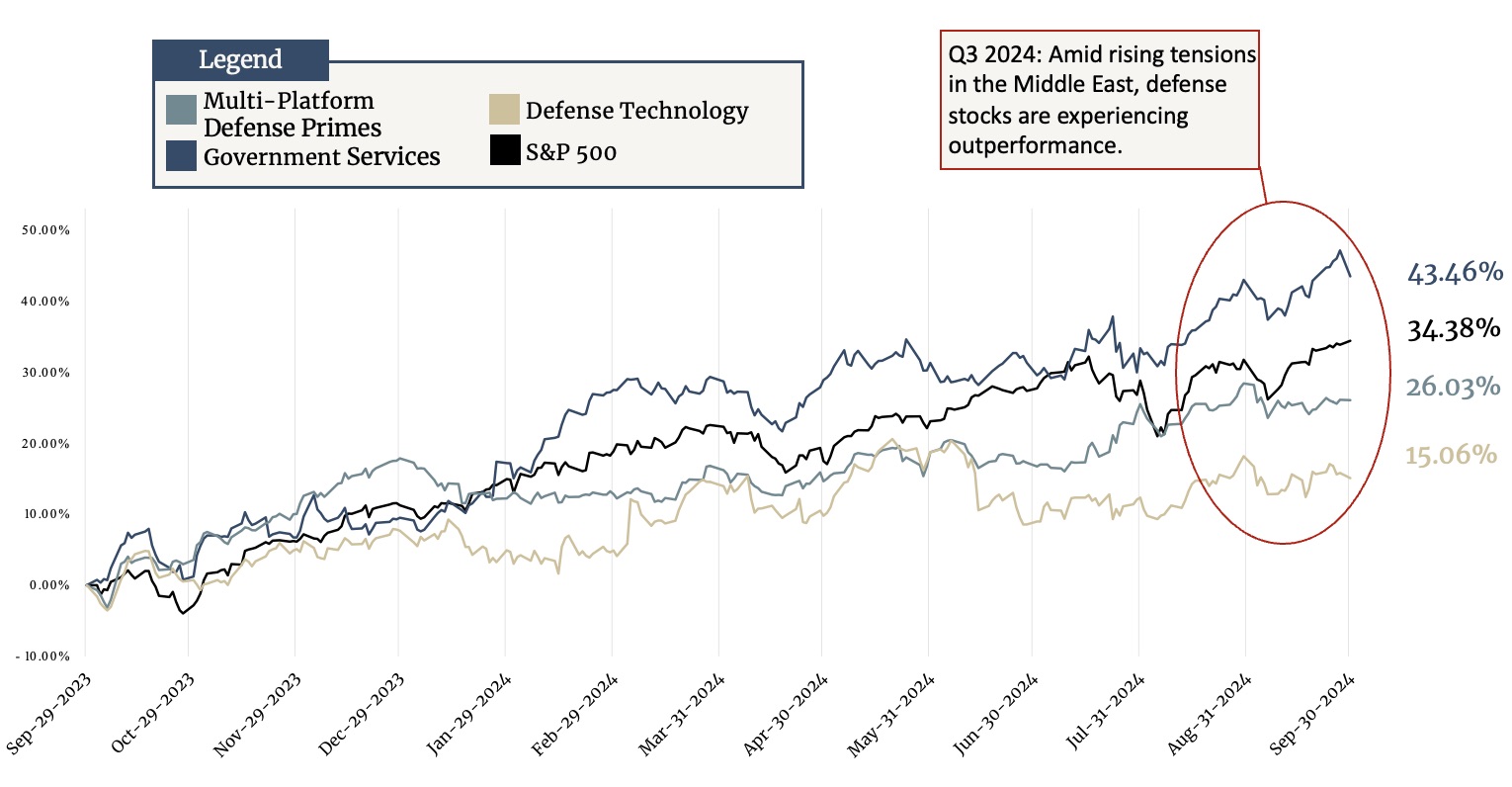

CCA Government Services Indices Stock Performance

- The government services and defense sectors are likely to see continued growth due to geopolitical tensions worldwide, technology innovation, and commercial air activity.

- In September 2024, the S&P 500 recorded its best performance in 11 years. Notably, companies reported strong earnings, and the Federal Reserve cut interest rates for the first time since 2020.

How CCA Helps Government Contractors

Chesapeake Corporate Advisors provides a framework for business owners to focus on building sustainable value and to explore their succession and exit alternatives. We use our proprietary tools and methodologies to assess the market and maximize value through strategy.

CCA is a leading investment bank with extensive expertise in mergers, acquisitions, divestitures, and corporate advisory. We use a comprehensive approach to assist clients develop and execute a buy-side, sell-side or recapitalization strategy domestically and in cross-border transactions.

At CCA, understanding shareholder value is at the center of everything that we do. Our analysis considers the feasibility of mergers, acquisitions, divestitures, ESOPs, management buy-outs and recapitalizations. We provide an objective, assessment of value that is deeply rooted in qualitative and quantitative analysis using our proprietary methodologies.

CCA’s Government Contracting team is a blend of Corporate Advisory, Investment Banking, and Government Contracting Executives. We have worked with dozens of companies in projects ranging from Sell Side Investment Banking, to Ownership Alternatives, to Valuations to Boards of Directors.

The CCA Government Contracting Team

Charlie Maskell

Managing Partner

Martin O'Neill

Managing Director

Michael Zuidema

Managing Director

Tim Brasel

Managing Director

Katie Kieran

Vice President

Andy Spears

Vice President

Kevin Afriyie

Associate

Frank Ihle

Analyst

Subscribe to Receive Industry Updates