INDUSTRY UPDATE | Q3 2023

Defense & Government

Firm Overview

CCA provides customized investment banking and corporate advisory services to middle market companies in the mid-Atlantic region. No matter where you are in your business life cycle, CCA can help you build shareholder value and achieve outcomes that best suit your goals.

20 years

28

Transactions Closed

Since 2020

84

2022 Valuations and Marketability studies

Corporate Advisory Services

We start by assessing the value and marketability of your business—arriving at an objective business valuation that serves as the essential foundation for determining how to enhance that value through strategic initiatives.

Then we use our proprietary framework to evaluate and arrive at the optimal strategic alternatives to help you achieve your goals. If a business succession or exit is in your plans, our team will help you explore the best options to set you on the right path and ensure a smooth transition—so the business is ready when you are.

Investment Banking Services

Clients have trusted CCA as their investment banking advisor for 30+ years. When you choose CCA as your investment banker, your goals become our goals. We take a comprehensive, holistic approach to achieving the most successful transactions, both domestically and across borders—from preparing you to go to market, through the process of negotiating and closing a deal that produces the optimal results.

Market Segment News

Companies serving the Intelligence and Cyber Markets encompass a wide range of offerings with a diverse set of skills and market segments. From Artificial Intelligence and Machine Learning to Cybersecurity and support for the warfighter, the people that make up these technology companies are actively involved in national security. Along with these “pointy edge of the sword companies” are support industries in staffing, construction, finance, and legal which serve to support the infrastructure, financial, and legal needs of this community.

New Cyber Threat Hunting Tool

IC Data Strategy Released

CACI Awarded Intel Analyst Contract

Parsons Secures CYBERCOM Contract

IronNet Ceases Operations

Deltek acquires Replicon

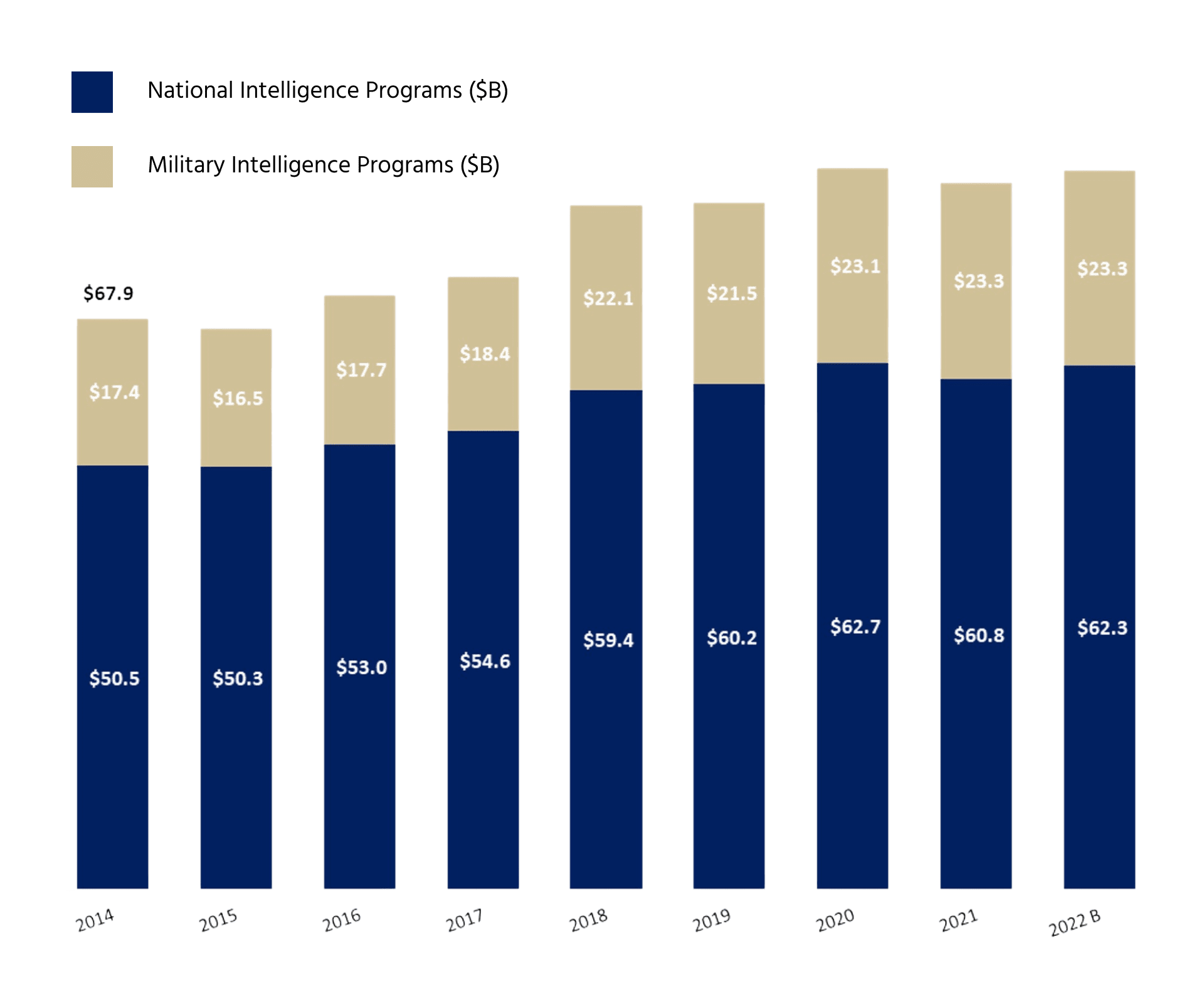

The Intelligence Community Budget

A program is primarily NIP if it funds an activity that supports more than one department or agency (such as satellite imagery), or provides a service of common concern for the IC (such as secure communications). The NIP funds the Central Intelligence Agency (CIA) and the Office of the Director of National Intelligence (ODNI) in their entirety, and the strategic intelligence activities associated with departmental IC elements such DOD’s National Security Agency (NSA).

A program is primarily MIP if it funds an activity that addresses a unique DOD requirement. Additionally, MIP funds may be used to “sustain, enhance, or increase capacity/capability of NIP systems.” The DNI and USD (I&S) work together in a number of ways to facilitate the integration of NIP and MIP intelligence efforts. Mutually beneficial programs may receive both NIP and MIP resources.

CCA Serves as the Exclusive Financial Advisor for Two Recent Deals

- Announced: August 23, 2023

- Sector: Intel & Cyber

- Description:Chesapeake Corporate Advisors (“CCA”) served as the exclusive financial advisor to Sealing Technologies, Inc. (“SealingTech” or the “Company”), in its sale to Parsons Corporation in a transaction valued at up to $200 million, including $175 million in cash at closing. SealingTech, a Columbia, MD based company, focuses on protecting and defending their customers’ networks and systems through cutting edge research, products, engineering, and integration services for the Internet of Things (IoT), edge combat operations, AI and ML, and cloud industries. The Company delivers innovative cybersecurity solutions across defensive cyber operations, critical infrastructure network protection, and secure data management. SealingTech is a prime contractor on over 90% of its federal contracts and is directly aligned with high-impact national security initiatives. Over 70% of the Company’s employees hold security clearances.

- Announced: August 1, 2023

- Sector: Intel & Cyber

- Description: Chesapeake Corporate Advisors (“CCA”) served as the exclusive financial advisor to Cyber Cloud Technologies, LLC (“Cyber Cloud” or the “Company”), an information technology services firm that provides a suite of enterprise IT services to the Federal Government, including cybersecurity and cloud services, in its sale to T-Rex Solutions, LLC (“T-Rex”), a leading IT professional services firm that helps the Federal Government modernize, protect, and scale its systems and data. This transaction expands T-Rex’s service offerings within the national security business area, where the Company continues to provide agile, innovative IT solutions. The acquisition will enhance T-Rex’s footprint within the intelligence community and provide increased career growth opportunities for cleared employees, the Company said. “Cyber Cloud Technologies and T-Rex have a similar company culture and dedication to mission that sets this collaboration up for success,” said Cyber Cloud Technologies CEO Frank ‘Kip’ Kippenbrock.

Recent Transaction Highlights

- Announced: September 6, 2023

- Sector: Gov-Tech

- Description:Systems Planning & Analysis (“SPA”), a leading global provider of innovative solutions in support of complex national security programs and defense priorities, has acquired PRKK, LLC (“PRKK” or the “Company”). Founded in 2006, PRKK’s mission is the advancement of Space Domain Awareness and Space Superiority. Systems Planning and Analysis, Inc. is a portfolio company of Arlington Capital Partners.

- Announced: September 20, 2023

- Sector: Gov-Tech

- Description: Proteus Capital Solutions, a Maryland-based private equity firm, has bought CSSI. Founded in 1990 and headquartered in Washington, D.C., CSSI works to improve national air transportation networks. The company offers transportation services using capabilities such as software development, systems engineering and integration, acquisition and program management, safety management, modeling, simulation, research and analysis. CSSI has over 175 employees and operates in five locations while serving customers across the U.S. and around the world.

- Announced: September 12, 2023

- Sector: Gov-Tech

- Description: ManTech International Corporation has completed the acquisition of Definitive Logic, a leading provider of digital transformation consulting and technology solutions for Defense, Homeland Security and Federal Civilian agencies. Based in Arlington, VA, Definitive Logic is a prominent player in the government contracting industry, respected for its strategic advisory capabilities in business system transformation for government customers. ManTech is a portfolio company of The Carlyle Group.

- Announced: August 2, 2023

- Sector: Gov-Tech

- Description: Arlington Capital Partners, a Washington, DC-based private equity firm, today announced that it acquired Integrated Data Services, Inc. (“IDS”). IDS’ co-founders Jerome Murray and James Truhe retained a minority stake in IDS as part of the transaction. Founded in 1997 and headquartered in El Segundo, CA, IDS is a leading provider of software and technology-enabled support and development for Federal Government customers.

- Announced: August 22, 2023

- Sector: Intel & Cyber

- Description:Owl Cyber Defense, the leading provider of hardware-enforced cyber security solutions for military, national security, intelligence and critical infrastructure organizations, announced that it has acquired Big Bad Wolf Security – a Maryland-based technology company focused on next generation cloud infrastructure security for government and commercial applications. Owl Cyber Defense Solutions is a portfolio company of DC Capital Partners.

- Announced: July 18, 2023

- Sector: Gov-Tech

- Description:IMB Partners (“IMB”), a leading middle market private equity firm specializing in utility, industrial, and government contracting services announced its strategic investment in eTelligent Group, a premier provider of emerging technologies and program management solutions to the U.S. Government. Founded in 2005, eTel has been leading the enterprise-wide transformation of critical business systems by managing the implementation and engineering of emerging technologies.

- Announced: July 3, 2023

- Sector: Gov-Tech

- Description: Akima, a premier provider of products and services to the Federal Government, announced that it has completed the acquisition of Pinnacle Solutions, Inc., a leading provider of innovative training and sustainment products and services to defense customers around the globe. The acquisition expands Akima’s aviation and training capabilities in the defense market and will further enable the company to provide significant value to its customers in the demanding aerospace industry.

- Announced: Kuly 134, 2023

- Sector: Intel & Cyber

- Description:The Swift Group, LLC announced its acquisition of OPS Consulting, an innovative solutions provider with advanced technologies in data analytics, high performance computing, and threat mitigation. OPS provides highly specialized mission critical technology services and solutions which support the U.S. Intelligence Community (“IC”) and Department of Defense (“DoD”).

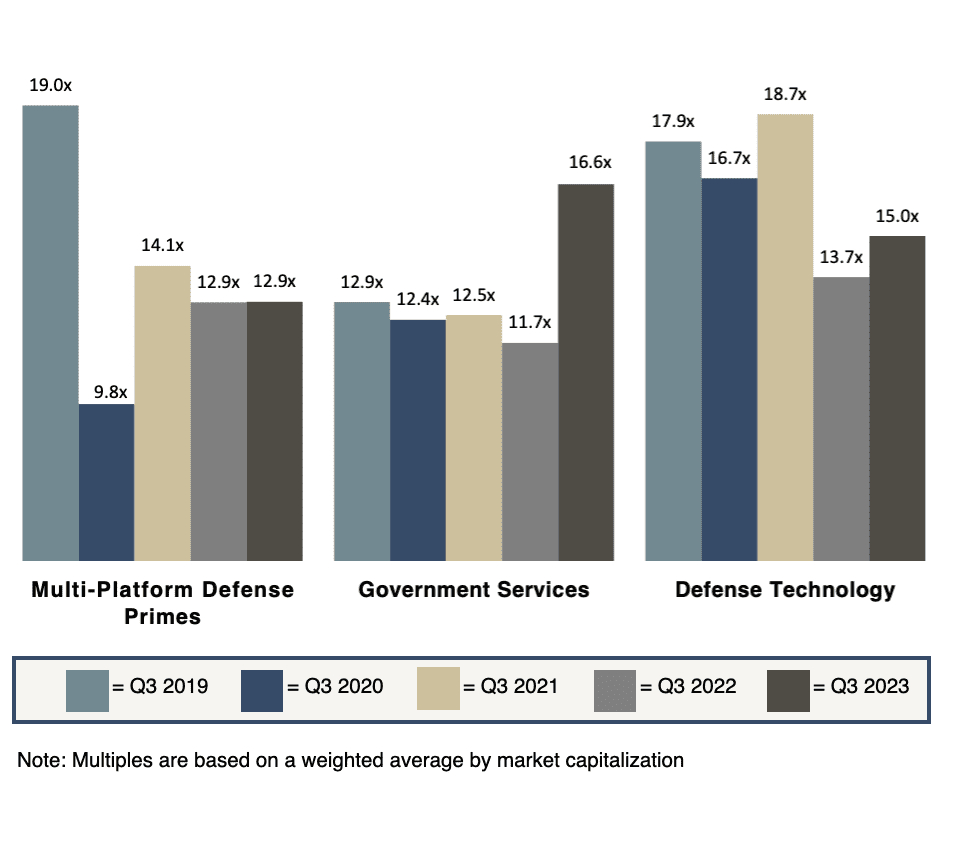

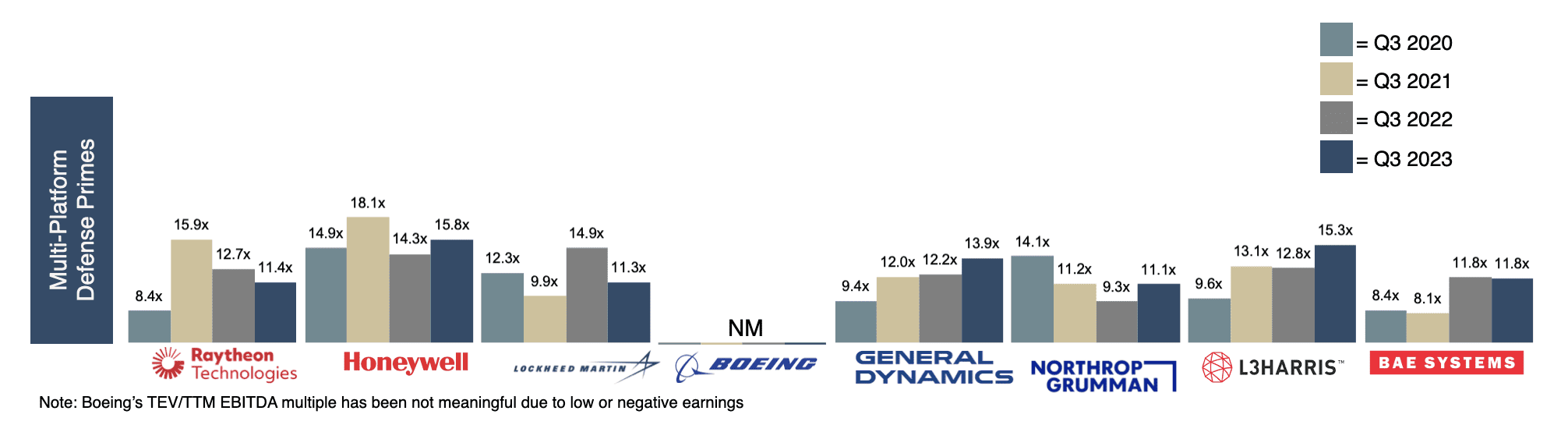

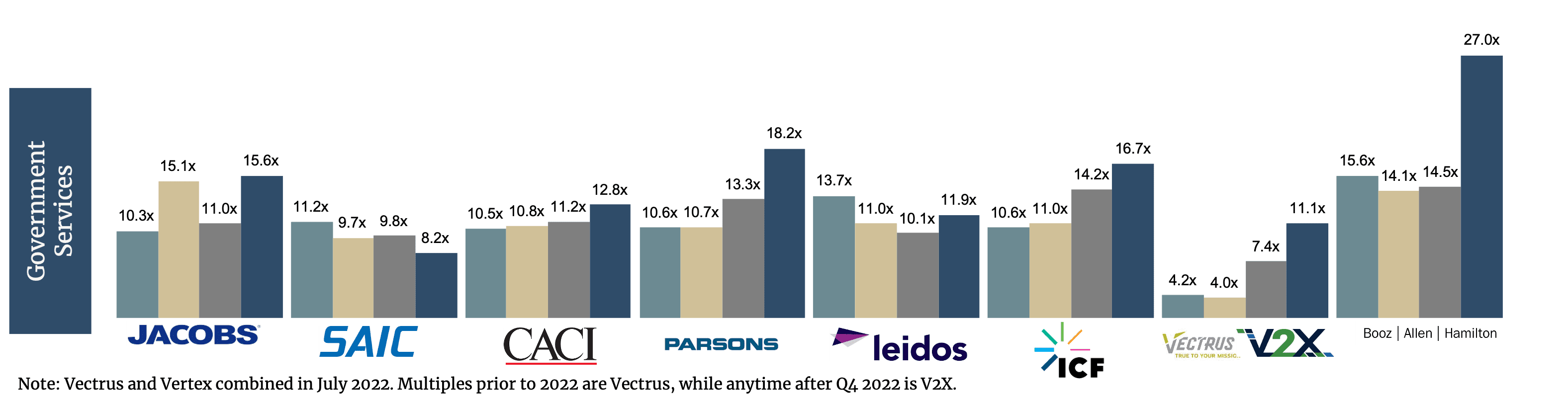

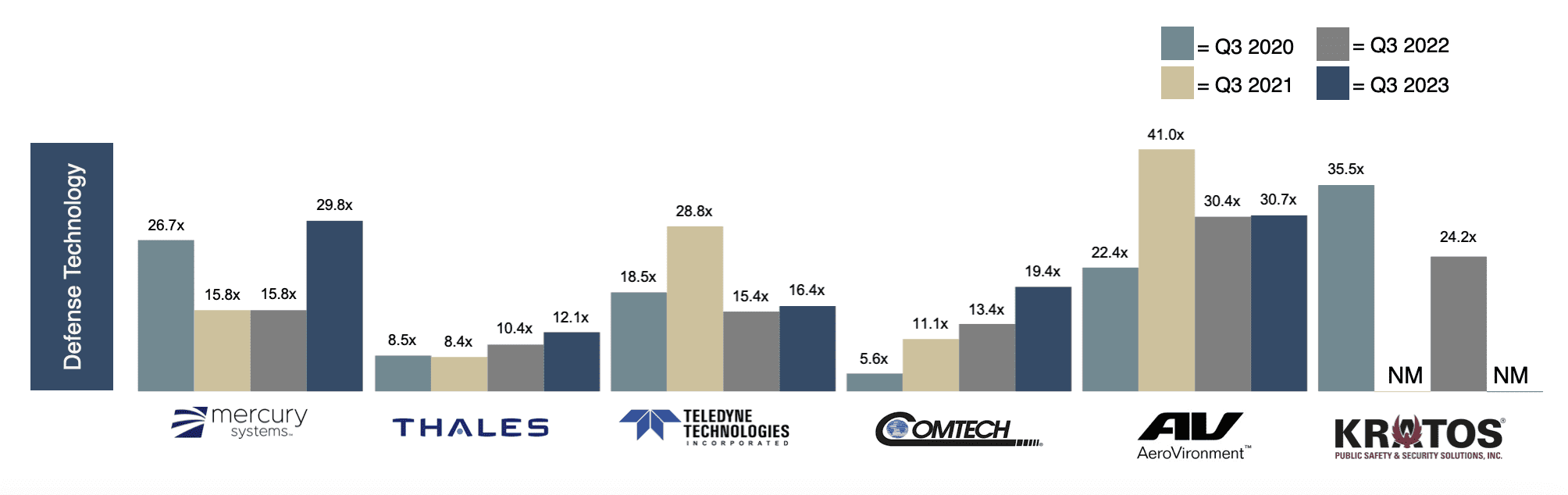

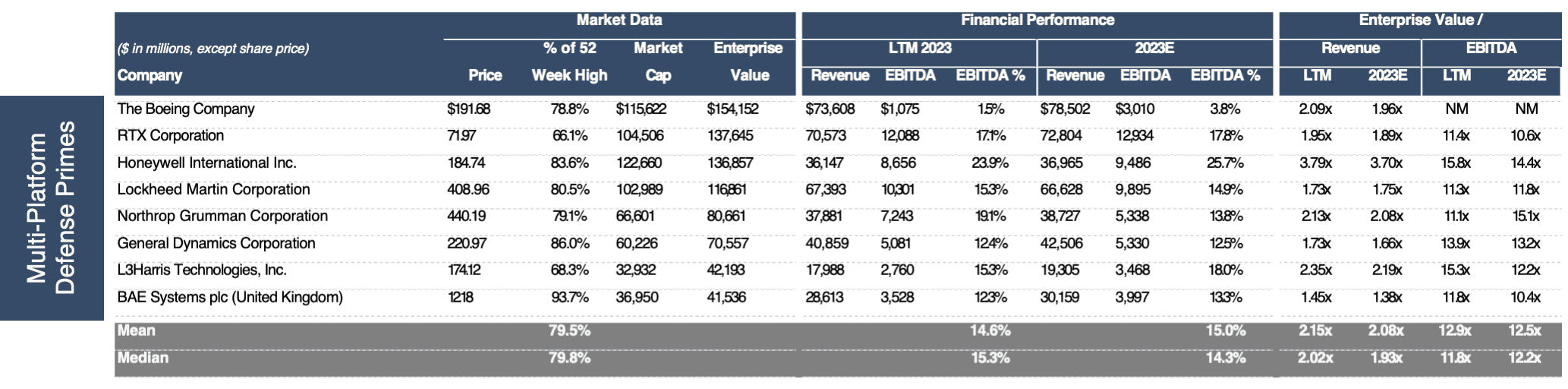

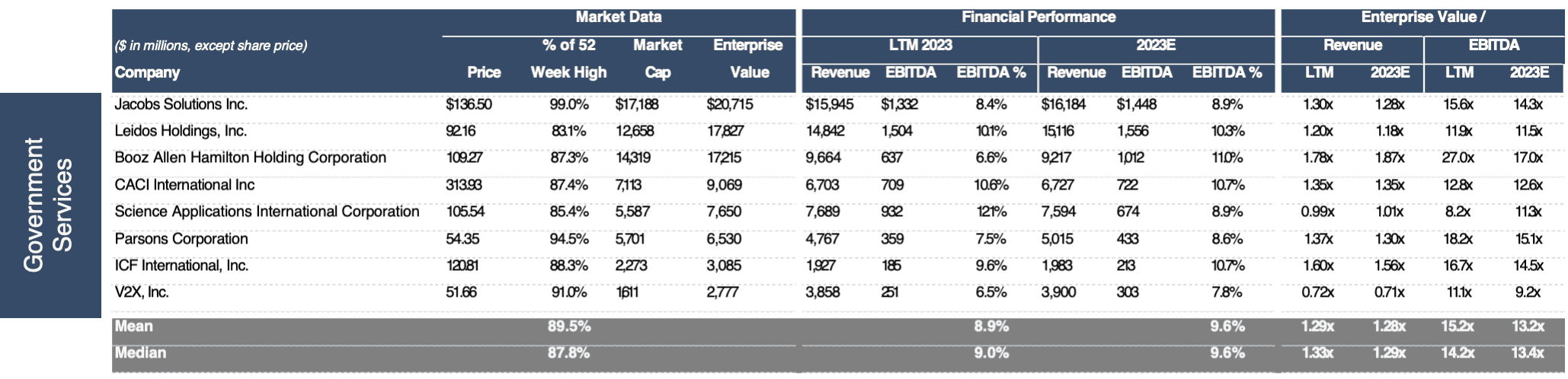

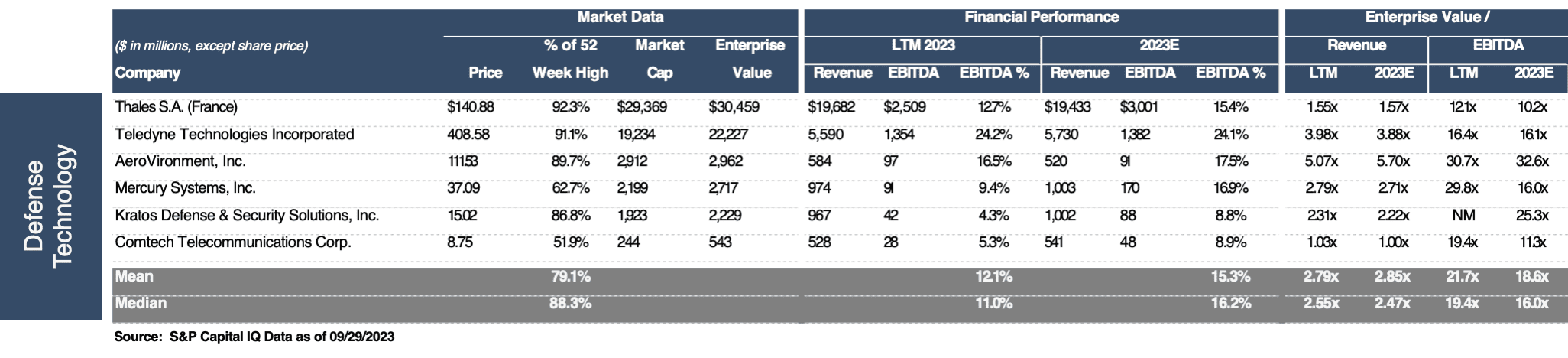

EV/EBITDA Public Valuation Multiples

As we monitor the Government Contracting Industry, we have classified some of the largest government contractors into three main industry sub sectors defined below.

Multi-Platform Defense Primes

Government Services

Defense Technology

Public Market Data

Source: S&P Capital IQ Data as of 09/29/2023

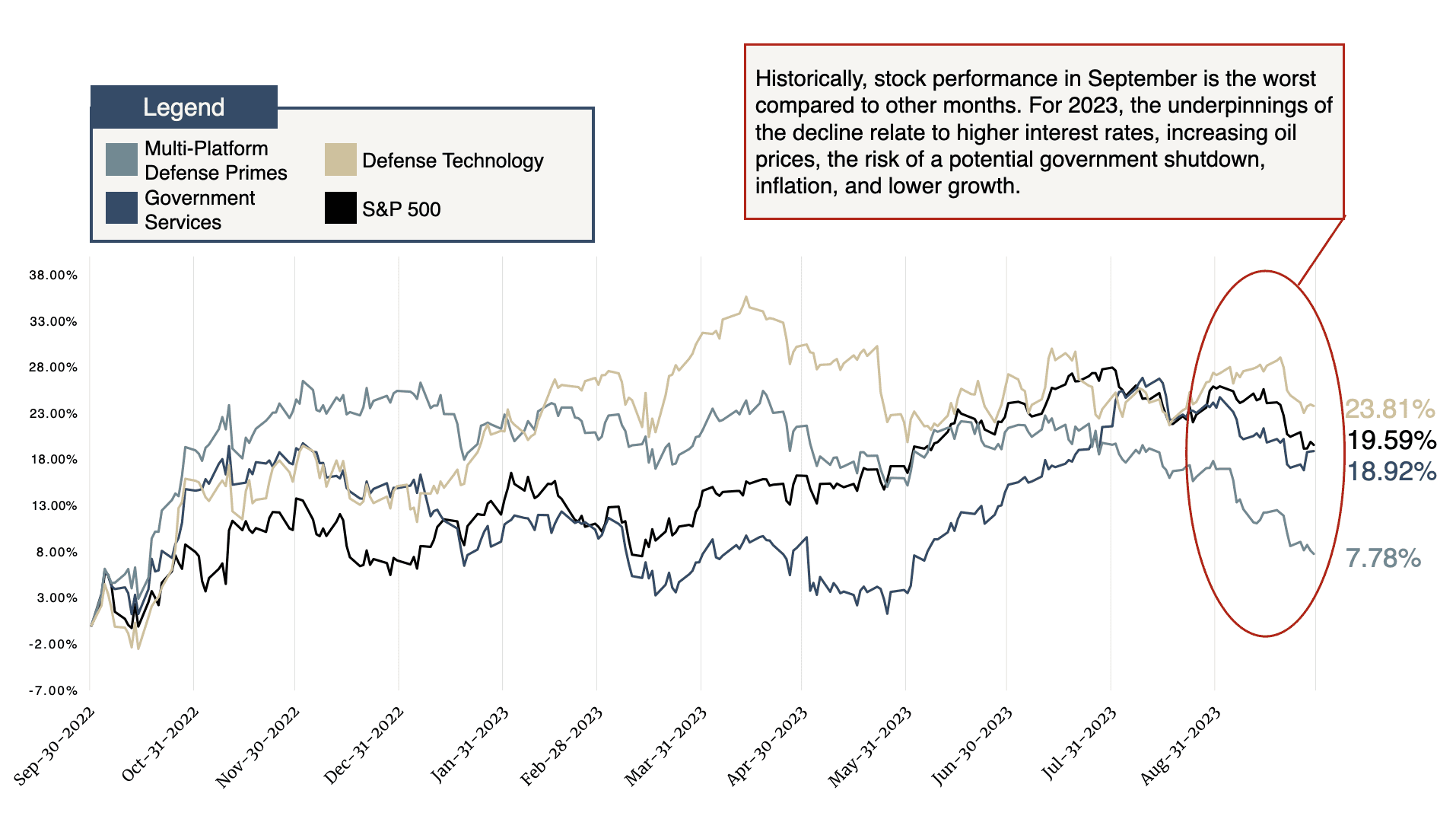

CCA Government Services Indices Stock Performance

In general, stock performance has rebounded with double-digit returns for the year ending September 30, 2023. The war in Ukraine continues as do heightened tensions in the South China Sea, driving demand for defense products and increasing defense spending.

How CCA Helps Government Contractors

Strategy &

Corporate Advisory

Chesapeake Corporate Advisors provides a framework for business owners to focus on building sustainable value and to explore their succession and exit alternatives. We use our proprietary tools and methodologies to assess the market and maximize value through strategy.

Investment Banking

Services

CCA is a leading investment bank with extensive expertise in mergers, acquisitions, divestitures, and corporate advisory. We use a comprehensive approach to assist clients develop and execute a buy-side, sell-side or recapitalization strategy domestically and in cross-border transactions.

Business Valuations &

Financial Opinions

At CCA, understanding shareholder value is at the center of everything that we do. Our analysis considers the feasibility of mergers, acquisitions, divestitures, ESOPs, management buy-outs and recapitalizations. We provide an objective, assessment of value that is deeply rooted in qualitative and quantitative analysis using our proprietary methodologies.

CCA’s Government Contracting team is a blend of Corporate Advisory, Investment Banking, and Government Contracting Executives. We have worked with dozens of companies in projects ranging from Sell Side Investment Banking, to Ownership Alternatives, to Valuations to Boards of Directors.

The CCA Government Contracting Team

Charlie Maskell

Managing Partner

Martin O'Neill

Managing Director

Michael Zuidema

Managing Director

Tim Brasel

Director

Katie Kieran

Vice President

Andy Spears

Vice President

Frank Ihle

Analyst

Aidan Olmstead

Analyst

Subscribe to Receive Industry Updates