INDUSTRY UPDATE | Q4 2023

Defense & Government

Firm Overview

CCA provides customized investment banking and corporate advisory services to middle market companies in the mid-Atlantic region. No matter where you are in your business life cycle, CCA can help you build shareholder value and achieve outcomes that best suit your goals.

20 years

28

Transactions Closed

Since 2020

84

2022 Valuations and Marketability studies

Corporate Advisory Services

We start by assessing the value and marketability of your business—arriving at an objective business valuation that serves as the essential foundation for determining how to enhance that value through strategic initiatives.

Then we use our proprietary framework to evaluate and arrive at the optimal strategic alternatives to help you achieve your goals. If a business succession or exit is in your plans, our team will help you explore the best options to set you on the right path and ensure a smooth transition—so the business is ready when you are.

Investment Banking Services

Clients have trusted CCA as their investment banking advisor for 30+ years. When you choose CCA as your investment banker, your goals become our goals. We take a comprehensive, holistic approach to achieving the most successful transactions, both domestically and across borders—from preparing you to go to market, through the process of negotiating and closing a deal that produces the optimal results.

Market Segment News

Companies serving the Intelligence and Cyber Markets encompass a wide range of offerings with a diverse set of skills and market segments. From Artificial Intelligence and Machine Learning to Cybersecurity and support for the warfighter, the people that make up these technology companies are actively involved in national security. Along with these “pointy edge of the sword companies” are support industries in staffing, construction, finance, and legal which serve to support the infrastructure, financial, and legal needs of this community.

Lt. Gen. Haugh Confirmed

The U.S. Senate voted to confirm President Joseph R. Biden, Jr.’s nomination of U.S. Air Force Lt. Gen. Timothy D. Haugh to the rank of General and to assume the duties as the Commander, U.S. Cyber Command (CYBERCOM), Director, National Security Agency (NSA)/Chief, Central Security Service (CSS). Lt. Gen. Haugh is scheduled to assume his new role following a change-of-command ceremony planned for early 2024.

President signs NDAA into Law

New Cryptologic Center in Colorado

2023 Cybersecurity Year in Review

L3 Harris to Put off M&A Activities

Coker Confirmed

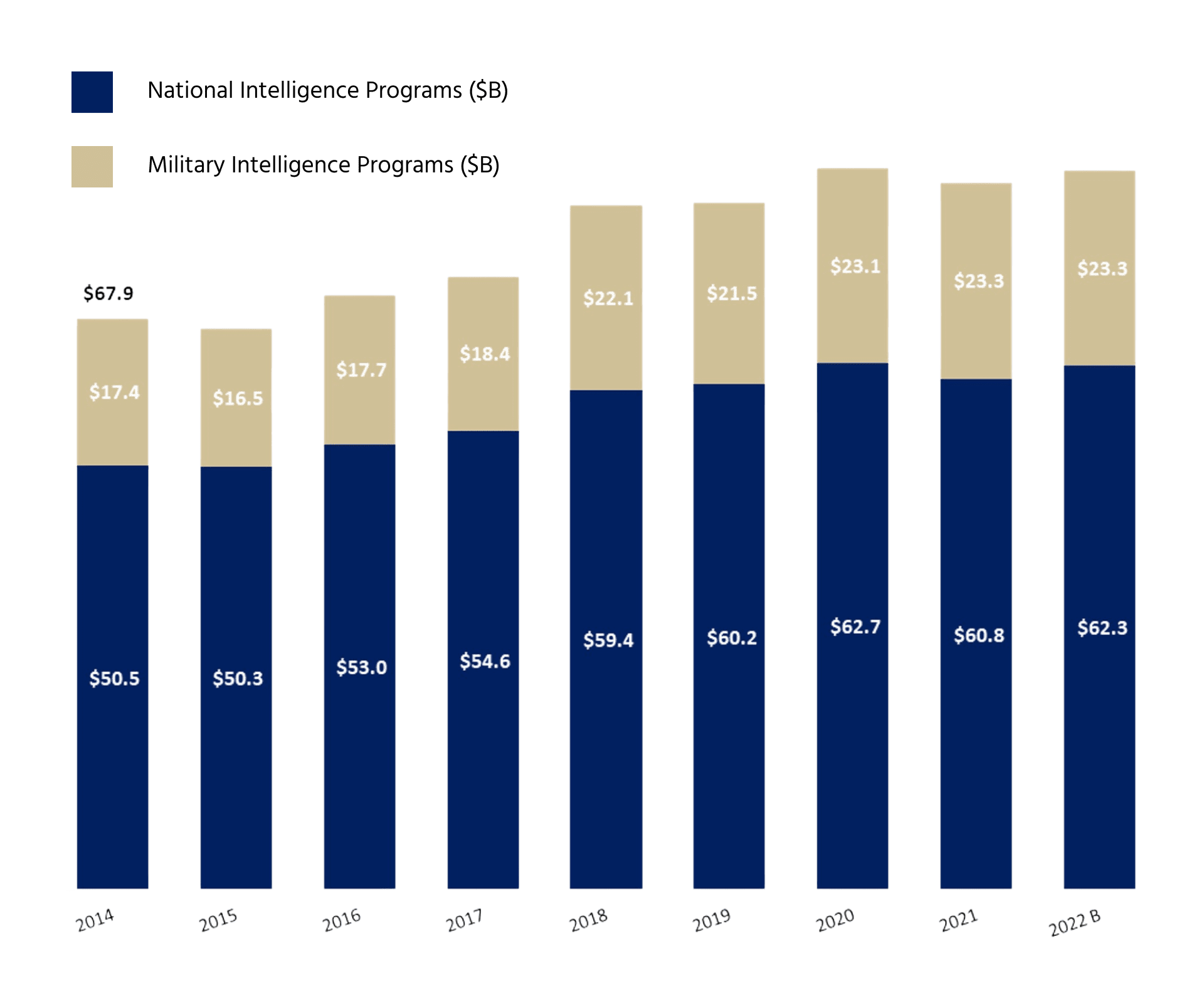

The Intelligence Community Budget

A program is primarily NIP if it funds an activity that supports more than one department or agency (such as satellite imagery), or provides a service of common concern for the IC (such as secure communications). The NIP funds the Central Intelligence Agency (CIA) and the Office of the Director of National Intelligence (ODNI) in their entirety, and the strategic intelligence activities associated with departmental IC elements such DOD’s National Security Agency (NSA).

A program is primarily MIP if it funds an activity that addresses a unique DOD requirement. Additionally, MIP funds may be used to “sustain, enhance, or increase capacity/capability of NIP systems.” The DNI and USD (I&S) work together in a number of ways to facilitate the integration of NIP and MIP intelligence efforts. Mutually beneficial programs may receive both NIP and MIP resources.

CCA Serves as the Exclusive Financial Advisor in Q4

Chesapeake Mission Critical Acquired by Fidelity Building Services Group

Chesapeake Mission Critical is a leading provider of advanced power and precision cooling products and services throughout Maryland, Virginia, and the Washington, D.C. area. Chesapeake Mission Critical has served the Maryland, Virginia, and DC markets for over 15 years, offering the most reputable products and solutions in the industry. CMC has developed mission critical solutions for many of the nation’s most secure and dependable facilities, from government agencies to Fortune 500 companies.

The Deal Team

CCA’s deal team included Managing Director Stuart Knott and Vice President Katie Kieran, who together developed the deal strategy, conducted the negotiations, and provided strategic advice throughout the transaction, along with Analyst Miles Gally.

CCA Serves as the Exclusive Financial Advisor for Two Recent Deals

- Announced: August 23, 2023

- Sector: Intel & Cyber

- Description:Chesapeake Corporate Advisors (“CCA”) served as the exclusive financial advisor to Sealing Technologies, Inc. (“SealingTech” or the “Company”), in its sale to Parsons Corporation in a transaction valued at up to $200 million, including $175 million in cash at closing. SealingTech, a Columbia, MD based company, focuses on protecting and defending their customers’ networks and systems through cutting edge research, products, engineering, and integration services for the Internet of Things (IoT), edge combat operations, AI and ML, and cloud industries. The Company delivers innovative cybersecurity solutions across defensive cyber operations, critical infrastructure network protection, and secure data management. SealingTech is a prime contractor on over 90% of its federal contracts and is directly aligned with high-impact national security initiatives. Over 70% of the Company’s employees hold security clearances.

- Announced: August 1, 2023

- Sector: Intel & Cyber

- Description: Chesapeake Corporate Advisors (“CCA”) served as the exclusive financial advisor to Cyber Cloud Technologies, LLC (“Cyber Cloud” or the “Company”), an information technology services firm that provides a suite of enterprise IT services to the Federal Government, including cybersecurity and cloud services, in its sale to T-Rex Solutions, LLC (“T-Rex”), a leading IT professional services firm that helps the Federal Government modernize, protect, and scale its systems and data. This transaction expands T-Rex’s service offerings within the national security business area, where the Company continues to provide agile, innovative IT solutions. The acquisition will enhance T-Rex’s footprint within the intelligence community and provide increased career growth opportunities for cleared employees, the Company said. “Cyber Cloud Technologies and T-Rex have a similar company culture and dedication to mission that sets this collaboration up for success,” said Cyber Cloud Technologies CEO Frank ‘Kip’ Kippenbrock.

Recent Transaction Highlights

- Announced: December 4, 2023

- Sector: Intel & Cyber

- Description: Reston, VA-based Acclaim Technical Services (ATS), a leader in specialized operational support, technology solutions, and language-enabled services to the U.S. Intelligence Community (IC) announced that it has acquired Alder Technology Corporation, a Chantilly, VA-based provider of high-end network engineering, network security, and data management services and solutions supporting the national security mission. The combination of the two firms cements ATS as a critical middle market company in the core IC landscape.

- Announced: December 4, 2023

- Sector: Gov-Tech

- Description: Capitol Meridian Partners has closed a fourth acquisition in the federal market through its purchase of Clarity Innovations, a provider of data and cyber analytics offerings to agencies. Terms of the transaction were not disclosed, but Clarity Innovations’ founders and senior leaders remain with the company and will hold an equity stake in it.

- Announced: November 29, 2023

- Sector: Gov-Tech

- Description: BlueHalo, a leading provider of critical capabilities and technologies across Space, Air, and Cyber domains, announced it has acquired Ipsolon Research. BlueHalo is a portfolio company of Arlington Capital Partners (“Arlington”), a Washington, D.C.-area private equity firm with extensive experience investing in regulated industries. Financial terms were not disclosed. Founded in 2018, Ipsolon designs and manufactures high-performance, ultra-small form factor Software Defined Radios (“SDR”) for use in mission-critical spaces constrained by harsh environments.

- Announced: November 27, 2023

- Sector: Intel & Cyber

- Description: Eqlipse Technologies, a leading provider of differentiated products and high‑end engineering solutions to the Department of Defense (DoD) and Intelligence Community (IC), announced it has agreed to acquire SR Technologies. Eqlipse is a portfolio company of Arlington Capital Partners, a Washington, D.C.-area private equity firm with extensive experience investing in regulated industries. Founded in 1998, SRT is a critical provider of signals intelligence (“SIGINT”) and electronic warfare (“EW”) technologies to leading governmental, military, and commercial organizations worldwide.

Target:

OASIC Engineering, LLC

- Announced: November 17, 2023

- Sector: Gov-Tech

- Description: Acclaim Technical Services, LLC (ATS) acquired the assets of privately held OASIC Engineering, LLC. Monrovia, Md.-based OASIC is a provider of hardware and software engineering services. The company employs highly specialized engineering subject-matter experts in integrated circuit design, engineering, and other critical areas expected to enhance ATS’s SIGINT development, collection, and analysis; mission and collection management; and intelligence analysis support.

- Announced: November 15, 2023

- Sector: Intel & Cyber

- Description: Washington Harbour Partners LP, a leading private investment firm that specializes in partnering with founders and management teams to unlock their next phase of growth, announced it has acquired SIXGEN Incorporated, a world-class cyber solutions company for the U.S. national security, intelligence, and defense communities, and critical commercial industries. The acquisition of SIXGEN is a natural fit for Washington Harbour’s operational and domain expertise in high-growth companies in non-cyclical industries. SIXGEN will continue to be led by the Company’s founder and CEO, Ethan Dietrich.

- Announced: October 31, 2023

- Sector: Intel & Cyber

- Description: Redhorse Corporation has completed its acquisition of Allied Associates International (A2I), a Gainesville, Virginia based cybersecurity and engineering company focused on critical national security concerns.

A2I develops software to extract actionable intelligence from data and provides cutting-edge technical products and services to the Defense, Federal Law Enforcement and Intelligence Communities. Their capabilities include a focus on cyber data analytics and software development in support of a wide range of cyber operations.

- Announced: October 26, 2023

- Sector: Intel & Cyber

- Description: Intelligence community services provider FireTeam Solutions acquired another software company that does business with the intelligence community, Case Consulting, expanding its capabilities and broadening its reach. Terms of the deal were not disclosed. FireTeam is a portfolio company of the private equity firm AE Industrial Partners (AEI).

FireTeam and Case will continue to use their respective brand names in the market. The combined entity, still a portfolio company of AEI, will be led by CEO Paul Farmer, who founded Case in 2012.

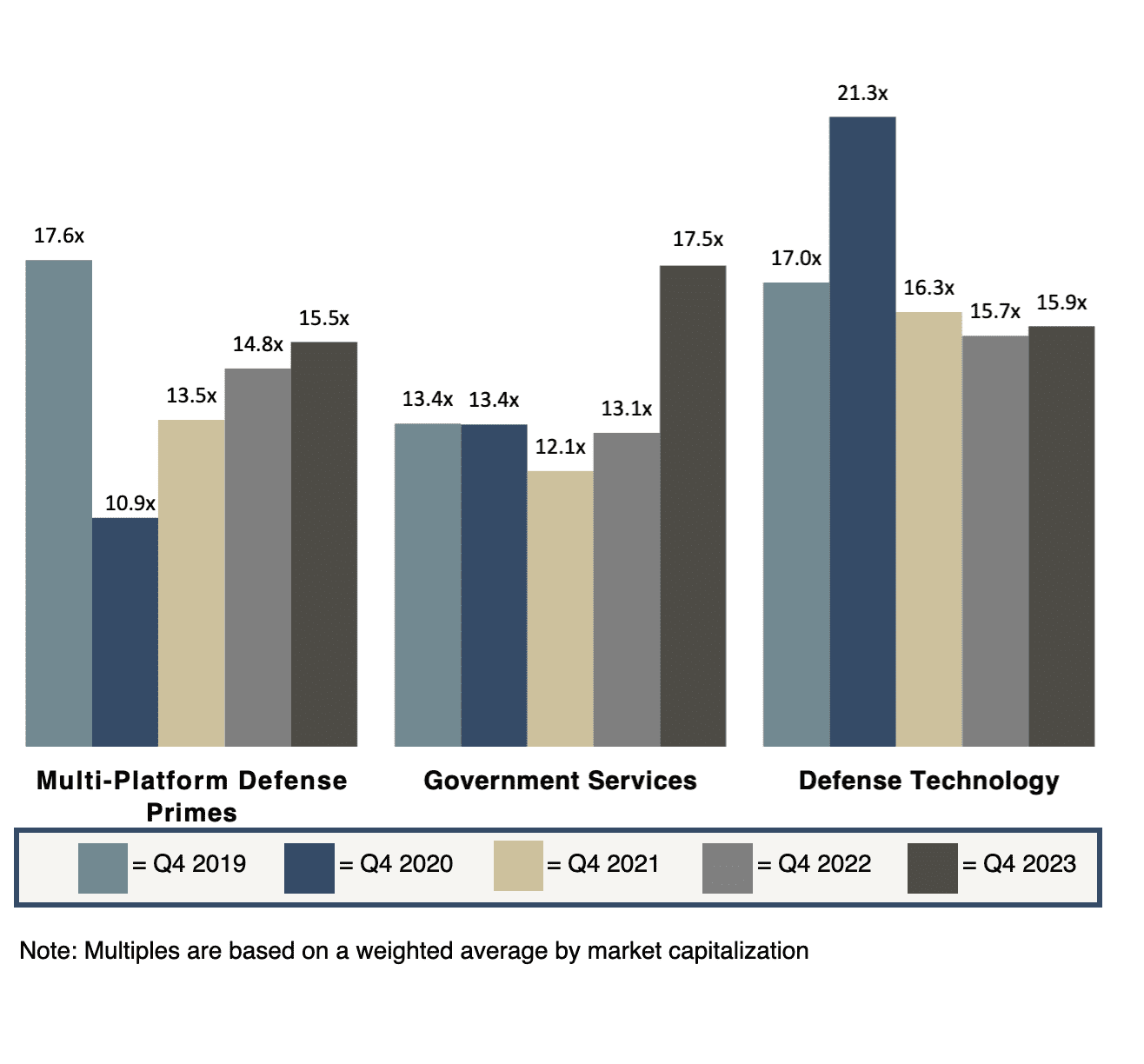

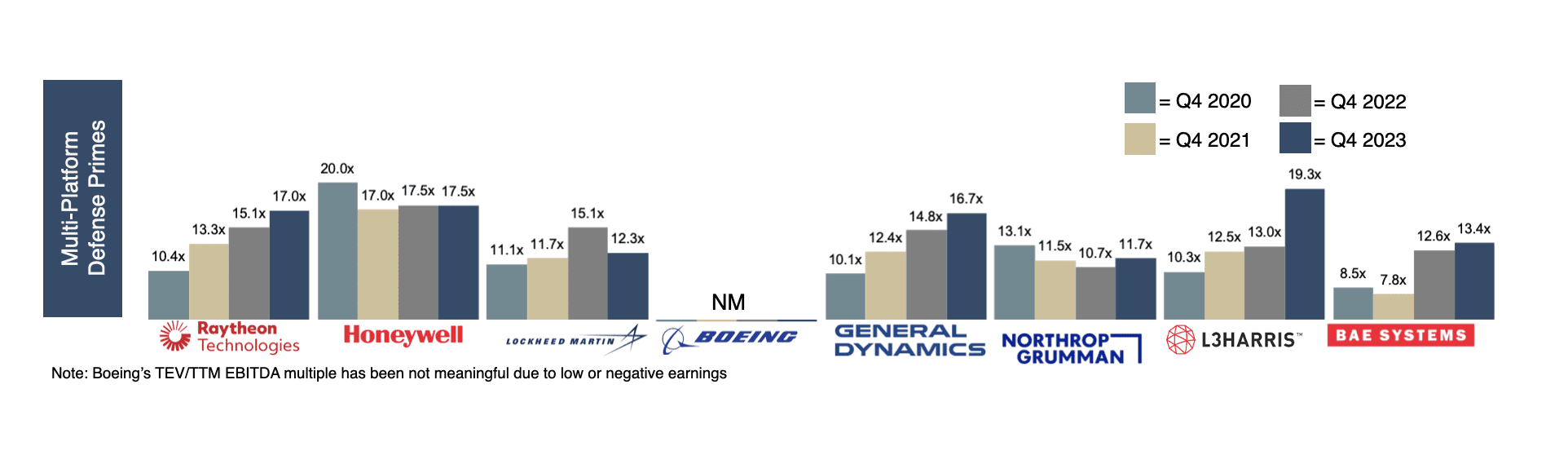

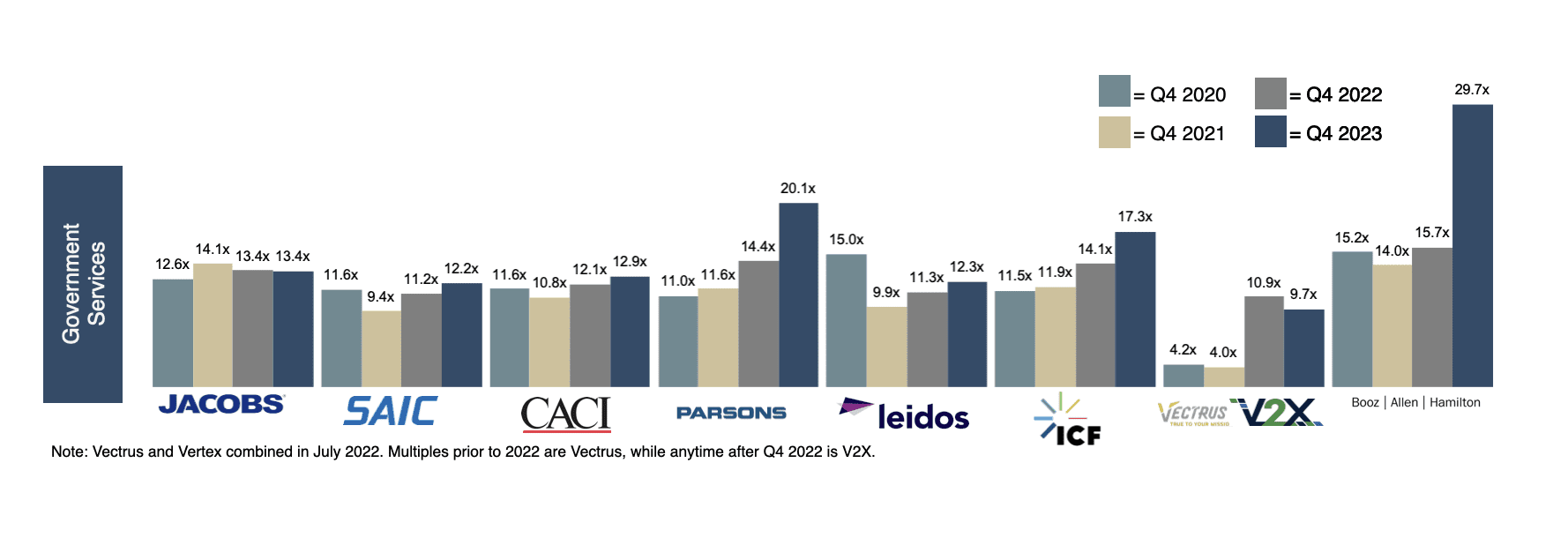

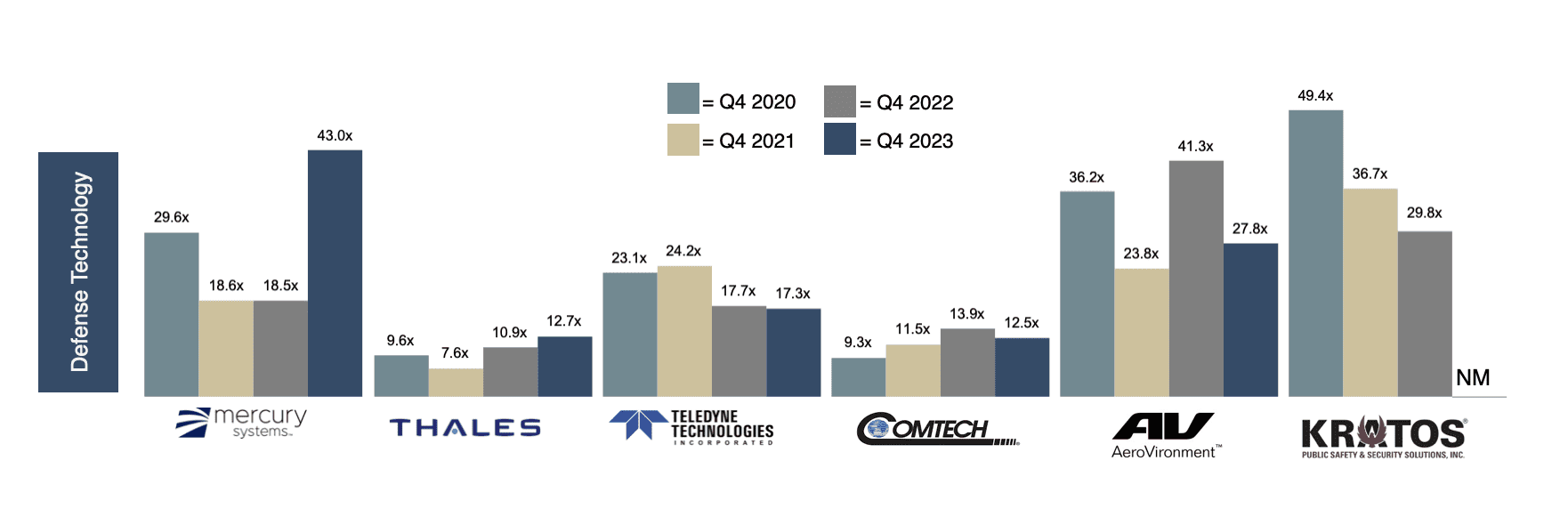

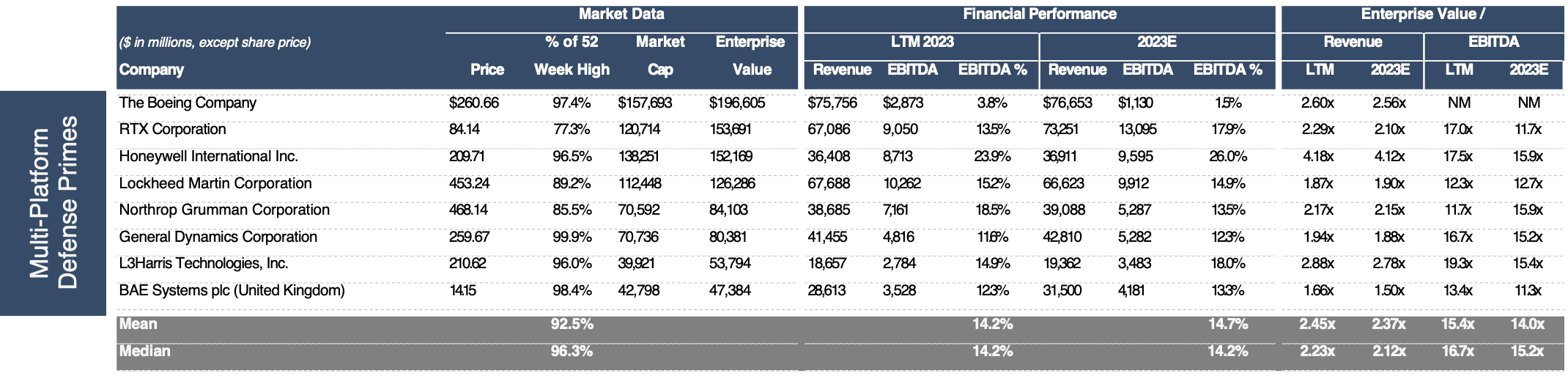

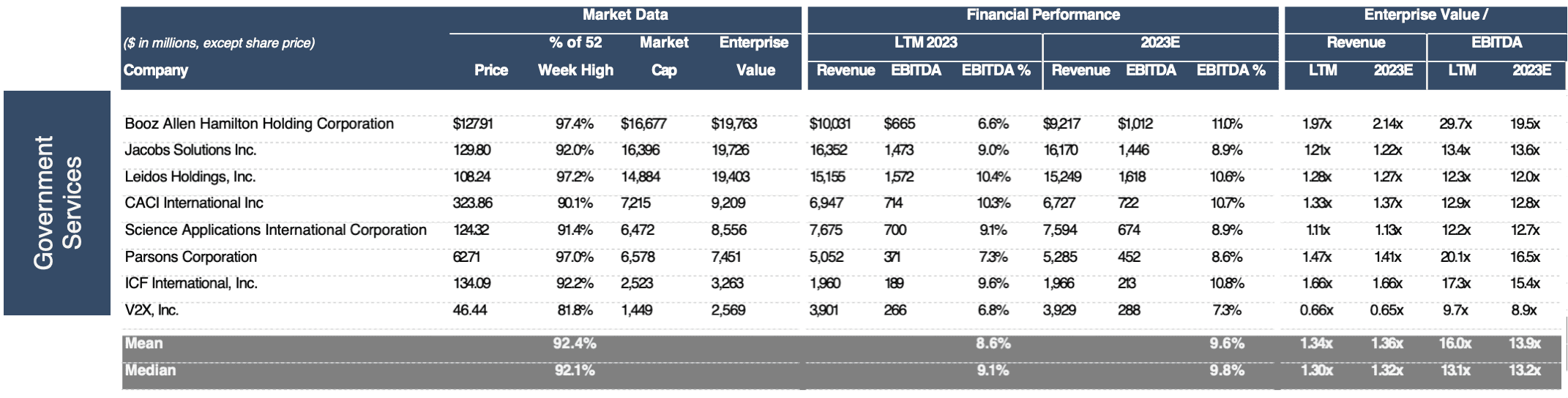

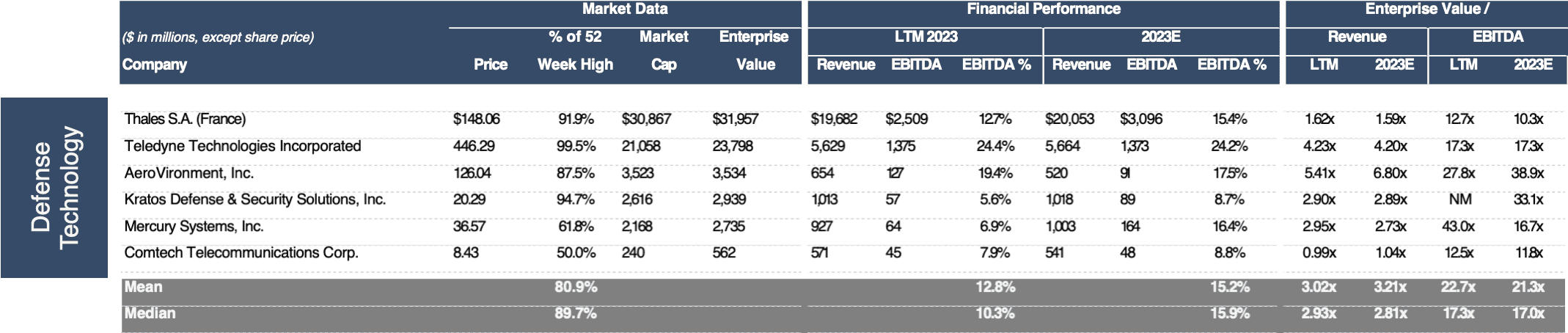

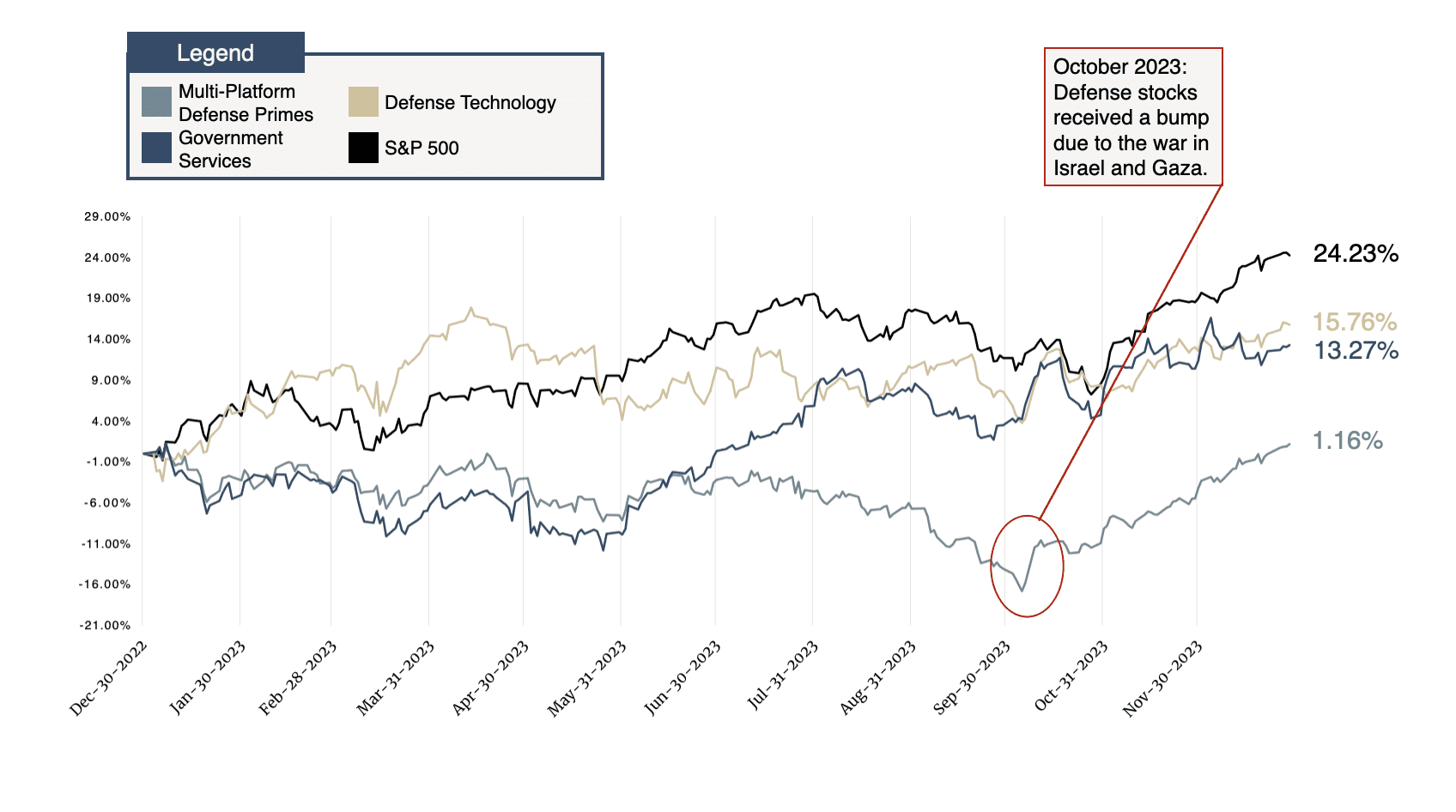

EV/EBITDA Public Valuation Multiples

As we monitor the Government Contracting Industry, we have classified some of the largest government contractors into three main industry sub sectors defined below.

Multi-Platform Defense Primes

Government Services

Defense Technology

Defense prime contractors specialize in the design, construction and support of defense-based products and services. Their work with the Federal Government is typically in a prime contracting relationship as they manage their supply chains and furnish services, supplies or construction to the Government.

Public Market Data

Source: S&P Capital IQ Data as of 12/29/2023

CCA Government Services Indices Stock Performance

- Even though Defense stocks witnessed high demand for weapons, their stock prices lagged, partially due to supply chain issues.

- The S&P 500 Index outperformed the Government Services & Defense stocks as a result of inflation subsiding, a steadfast economy, and an anticipation of interest rate cuts in 2024.

How CCA Helps Government Contractors

Strategy &

Corporate Advisory

Chesapeake Corporate Advisors provides a framework for business owners to focus on building sustainable value and to explore their succession and exit alternatives. We use our proprietary tools and methodologies to assess the market and maximize value through strategy.

Investment Banking

Services

CCA is a leading investment bank with extensive expertise in mergers, acquisitions, divestitures, and corporate advisory. We use a comprehensive approach to assist clients develop and execute a buy-side, sell-side or recapitalization strategy domestically and in cross-border transactions.

Business Valuations &

Financial Opinions

At CCA, understanding shareholder value is at the center of everything that we do. Our analysis considers the feasibility of mergers, acquisitions, divestitures, ESOPs, management buy-outs and recapitalizations. We provide an objective, assessment of value that is deeply rooted in qualitative and quantitative analysis using our proprietary methodologies.

CCA’s Government Contracting team is a blend of Corporate Advisory, Investment Banking, and Government Contracting Executives. We have worked with dozens of companies in projects ranging from Sell Side Investment Banking, to Ownership Alternatives, to Valuations to Boards of Directors.

The CCA Government Contracting Team

Charlie Maskell

Managing Partner

Martin O'Neill

Managing Director

Michael Zuidema

Managing Director

Tim Brasel

Managing Director

Tim leads the day-to-day management and execution of many of the deals CCA transacts for its clients. He’s helped lead and guide the sale and acquisition of numerous middle market companies. Learn more:

Katie Kieran

Vice President

Andy Spears

Vice President

Frank Ihle

Analyst

Aidan Olmstead

Analyst

Subscribe to Receive Industry Updates