INDUSTRY UPDATE | Q4 2024

Defense & Government

CCA releases quarterly updates regarding relevant market insights for the Defense and Government Contracting space. Interested in receiving the updates via email? Subscribe here.

Firm Overview

CCA provides customized investment banking and corporate advisory services to lower middle market companies in the Mid-Atlantic region. No matter where you are in your business life cycle, CCA can help you build shareholder value and achieve outcomes that best suit your goals.

20 years

30

Transactions Closed Since 2020

84

2023 Valuations and Marketability studies

Corporate Advisory Services

- Value Creation

- Succession and Exit Planning

- Growth Plan Evaluation

- Valuations & Appraisal

- Fairness Opinion

- ESOP Feasibility Study

- Stockholder Agreement

Investment Banking Services

- Sell-Side

- Buy-Side

- Merger

- Recapitalization

- Growth Capital

- Management Buyout

Intel and Cyber News

Companies serving the Intelligence and Cyber Markets encompass a wide range of offerings with a diverse set of skills and market segments. From Artificial Intelligence and Machine Learning to Cybersecurity and support for the war fighter, the people that make up these technology companies are actively involved in national security. Along with these “pointy edge of the sword companies” are support industries in staffing, construction, finance, and legal, which serve the various needs of this community.

Hybrid Compute Initiative

After years of development, the NSA’s top-secret hybrid cloud environment is now operational. The NSA has been pursuing the “Hybrid Compute Initiative” since at least 2020. The agency’s goal is to evolve the NSA’s on-premise GovCloud environment into a mix of cloud capabilities and hardware-as-a-service offerings. The Hybrid Compute Initiative is complementary to the CIA’s Commercial Cloud Enterprise (C2E) contract, Source: Federal News Network.

DNI Releases Appropriated Budget

Congress appropriated an aggregate amount of $76.5 billion to the National Intelligence Program (NIP) for Fiscal Year 2024. This amount includes supplemental funding. The Director of National Intelligence (DNI) discloses this amount consistent with 50 U.S.C. 3306(b), not later than 30 days after the end of the fiscal year. Beyond the disclosure of the NIP top-line figure, there will be no other disclosures of currently classified NIP budget information.

CMMC 2.0 Implementation

This year the Pentagon released its final rule for the long-awaited CMMC 2.0, which sets new standards for contractors who handle (CUI). The 32 Code of Federal Regulations (CFR) final rule, which lays the framework, went into effect on Dec. 16, but the DoD won’t actually begin implementing the requirement for contractors until the 48 CFR final rule is released — likely in the spring of 2025.

M&A Deal Flow in Intel and Cyber

Despite GovCon M&A deals being relatively flat in through September 2024, volumes for both private equity (PE) and corporate M&A deals are up an impressive 17% year-to-date versus 2023. Momentum slowed late this year, in part due to elevated uncertainty (interest rates, election). E&Y estimates that total US deal volume (PE plus corporate M&A) will rise 10% in 2025, following an expected 13% advance in 2024.

Two Large Deals worthy of Analysis

- Amentum finalized its merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence businesses, emerging as a public government technology services leader with more than 53,000 employees operating in 80 countries.

- AeroVironment entered into a $4.1 billion all-stock deal to acquire BlueHalo, forming a diversified defense technology firm. The transaction is expected to close in the first half of 2025.

DNI Haines Statement on Pres Carter

“He will be remembered not only for his great service to our nation as its 39th President, but also for his life-long focus on human rights, fighting poverty, and promoting democracy and peace. He consistently pushed us to be better and never gave in to cynicism. I am grateful for his inspiring leadership and his incredible contributions — he made the world, in large and small ways, a better place for us all.”

CCA Serves as the Exclusive Financial Advisor in Q4

SSATI Acquires DATASYNC

Sensible Solutions and Technologies, Inc. (SSATI), a custom software development and system integration leader in the U.S. national security community, announced the successful acquisition of Data Sync Technologies, Inc. (DataSync), a leader in knowledge management and data analysis. This strategic acquisition expands SSATI’s footprint within the intelligence community to new government agency customers and provides DataSync employees greater opportunity for career advancement.

VETEGRITY Recapitalized by Private Investor Group

Vetegrity, LLC, a Maryland-based provider of professional services to the Department of Defense (DoD) and Intelligence Community (IC), announced a management restructuring and recapitalization of the company. This strategic move marks a new chapter in the company’s growth and innovation. The recapitalization and new management structure underscore Vetegrity’s commitment to innovation and growth, as well as its dedication to providing exceptional value to its government clients, partners and employees.

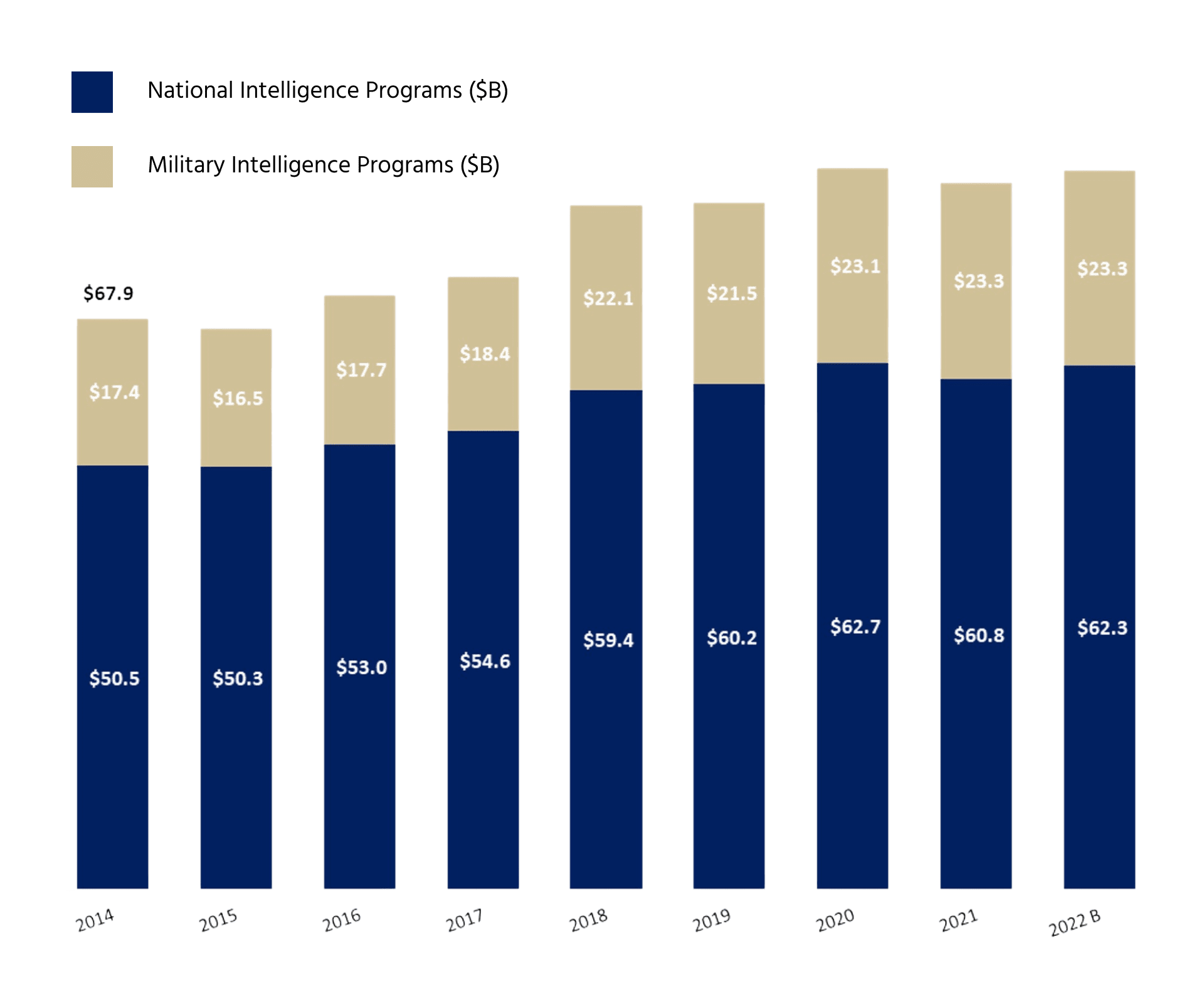

The Intelligence Community Budget

The United States Intelligence Community is a group of separate United States government intelligence agencies and subordinate organizations that work separately yet together to conduct intelligence activities to support the foreign policy and national security of the United States.

The National Intelligence Program (NIP) includes all programs. IC programs are funded through the: (1) NIP, which covers the programs, projects, and activities of the IC oriented toward the strategic requirements of policymakers, and (2) Military Intelligence Program (MIP), which funds defense intelligence activities intended to support tactical military requirements and operations. A program is primarily NIP if it funds an activity that supports more than one department or agency (such as satellite imagery), or provides a service of common concern for the IC (such as secure communications). The NIP funds the Central Intelligence Agency (CIA) and the Office of the Director of National Intelligence (ODNI) in their entirety, and the strategic intelligence activities associated with departmental IC elements such DOD’s National Security Agency (NSA). A program is primarily MIP if it funds an activity that addresses a unique DOD requirement. Additionally, MIP funds may be used to “sustain, enhance, or increase capacity/capability of NIP systems.” The DNI and USD (I&S) work together in a number of ways to facilitate the integration of NIP and MIP intelligence efforts. Mutually beneficial programs may receive both NIP and MIP resources.

CCA Government Services Indices Stock Performance

- The new Trump administration may change the government services and defense sector, with recent picks to co-lead the Department of Government Efficiency, due to potential policy changes and budget cuts. Additionally, small business set-asides might be impacted.

- The S&P 500 returned a gain of 20%+ for the second straight year.

How CCA Helps Government Contractors

Chesapeake Corporate Advisors provides a framework for business owners to focus on building sustainable value and to explore their succession and exit alternatives. We use our proprietary tools and methodologies to assess the market and maximize value through strategy.

CCA is a leading investment bank with extensive expertise in mergers, acquisitions, divestitures, and corporate advisory. We use a comprehensive approach to assist clients develop and execute a buy-side, sell-side or recapitalization strategy domestically and in cross-border transactions.

At CCA, understanding shareholder value is at the center of everything that we do. Our analysis considers the feasibility of mergers, acquisitions, divestitures, ESOPs, management buy-outs and recapitalizations. We provide an objective, assessment of value that is deeply rooted in qualitative and quantitative analysis using our proprietary methodologies.

CCA’s Government Contracting team is a blend of Corporate Advisory, Investment Banking, and Government Contracting Executives. We have worked with dozens of companies in projects ranging from Sell Side Investment Banking, to Ownership Alternatives, to Valuations to Boards of Directors.

The CCA Government Contracting Team

Charlie Maskell

Managing Partner

Martin O'Neill

Managing Director

Michael Zuidema

Managing Director

Tim Brasel

Managing Director

Katie Kieran

Vice President

Andy Spears

Vice President

Kevin Afriyie

Associate

Frank Ihle

Analyst

Subscribe to Receive Industry Updates