INDUSTRY UPDATE | Q1 2025

Architecture, Engineering & Construction

Service Areas

Architecture

- Design

- Planning

- Landscape

Engineering

- Transportation

- Infrastructure

- Utilities

- CI/CM

- MEP

- Design/Build

- Government

Construction

- General Contracting

- Infrastructure Svcs

- Electrical

- Concrete

- Mechanical

- Civil/Demolition

Sell-Side M&A Experience

Select Corporate Advisory Clients

Key Trends Impacting the AEC Sector

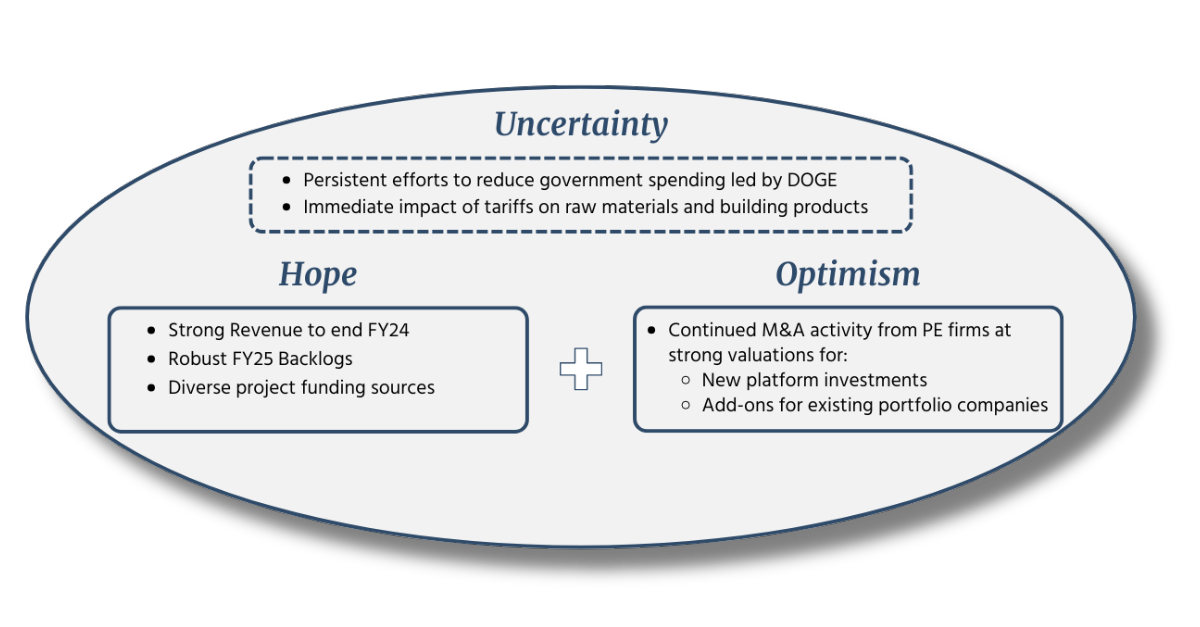

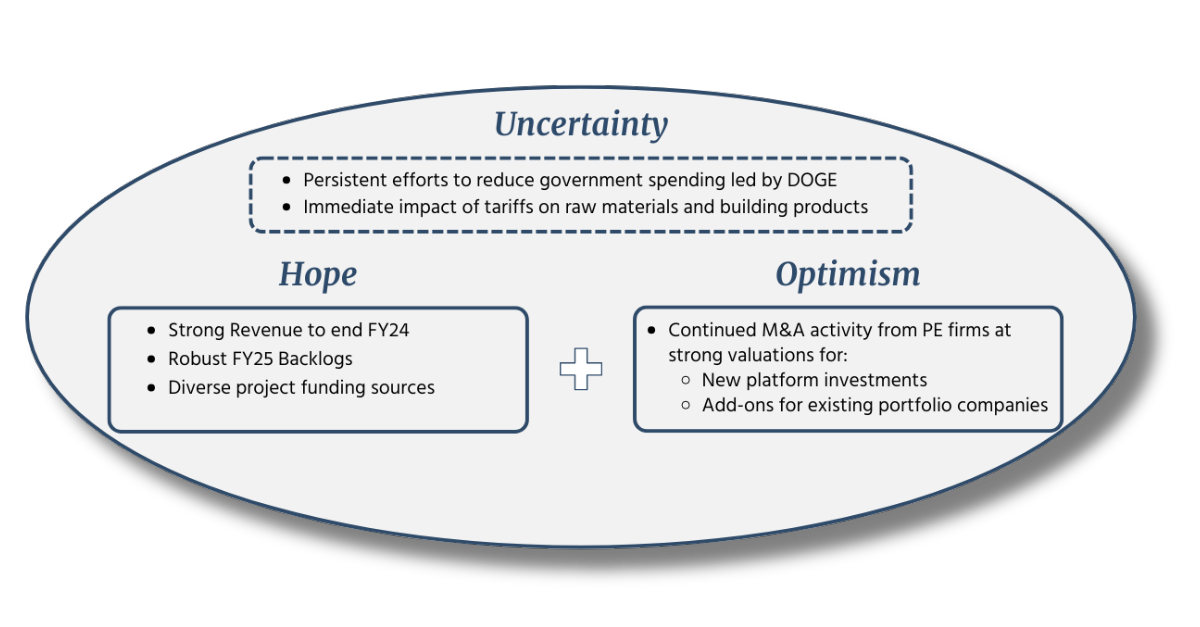

Hope and optimism in the AEC industry amidst a period of continued political uncertainty.

The vast number of AEC firms recognized profits during 2024 and entered 2025 with strong backlog. According to ENR, 93% of the Top 500 design firms reported profits and approximately 80% of the same firms reported the same or higher backlogs at the end of 2024 than reported at the end of 2023. The trend of infrastructure and transportation focused firms leading other sectors in spending continues, with 55% of market revenue is coming from the private sector, 35% coming from state and local jurisdictions, and less than 10% coming from federal spending according to ENR. Thus, it is surprising that federal spending is such a small portion of the AEC market.

Yet, just as we came into 2025 with a great deal of optimism for the AEC market, continued tensions around the Department of Government Efficiency (“DOGE”) and a broad array of U.S. tariffs on foreign imports became the focal point of the U.S. economy as a whole. These factors shifted sentiments of optimism to feelings hesitation and anxiety. For example, early expectations were that infrastructure spending would increase under the Trump administration; not so fast, as government downsizing continues, and concerns over the certainty of revenue growth in 2025 have become front and center of the leadership of most large AEC firms. Uncertainty around the impact of tariffs continues to loom large with no clear answer, specifically with the impact on building materials and other project costs. The market consensus is that project costs will increase dramatically but for how long, no one quite knows.

That said, with reported levels of backlog coming into 2025 remaining strong, the ever-aging U.S. infrastructure, and the exponentially increasing needs for energy distribution, the prospects for 2025 remain optimistic. While often overlooked amongst the turmoil in Washington, D.C., these positive factors have continued to underpin the unrelenting interest from private equity firms in the AEC sector, in both new platform investments and add-ons to existing portfolio companies.

The words of Yogi Berra were never more appropriate. “It is difficult to make predictions, especially about the future.” So, we close with we will need to wait and see what the remainder of 2025 brings.

Source: Engineering News Report

CCA AEC Sector Index Performance

Market Commentary

- Construction Services was the only AEC sector index to yield positive year-over-year growth as strong backlogs consisting of major retrofit infrastructure projects remain the primary focus in private markets as well as the state and local levels.

- Diversified Industrials Services companies saw a slight decrease in year-over-year performance. While power distribution projects continue to be a strong tailwind, political uncertainty around spending and tariffs on building materials have resulted in project delays and cost overruns.

- Engineering & Professional Services firms have felt the effects of construction project delays as future architectural and engineering design phases have been pushed out as well. Furthermore, the continued difficulties around skilled talent acquisition and rising costs of the existing employee base continues to create pressure on margins. However, specialized engineering services are still in high demand to support strong end commercial, industrial, and transportation end markets.

CCA’s Investment Banking Team

- M&A Advisory

- Capital Raising

- Recapitalizations

Charlie Maskell

Managing Partner

Tim Brasel

Managing Director

Martin O'Neill

Managing Director

Stuart Knott

Managing Director

Andy Spears

Director

Katie Kieran

Director

Kevin Afriyie

Associate

Matthew Metzger

Associate

Aidan Olmstead

Associate

Subscribe to Receive Industry Updates